Record-Breaking Economic Shift in the USA: How It Impacts Your Finances and Future

The Record-Breaking Economic Shift in the USA is not just another economic headline—it is a transformative event influencing everyone from big investors to everyday consumers. This article breaks down the complexities of this economic shift into easily understandable insights, helping you make informed decisions about your finances, investments, and business strategies.

Table of Contents

What is the Record-Breaking Economic Shift in the USA?

The Record-Breaking Economic Shift in the USA refers to the unprecedented changes in economic trends, marked by evolving investment strategies, distinct growth patterns across sectors, and changing consumer behaviors. This shift is reshaping the American financial landscape, creating new opportunities and challenges for individuals and businesses alike.

Key Drivers of the Economic Shift

1. Shifting Investment Patterns: The Global Perspective

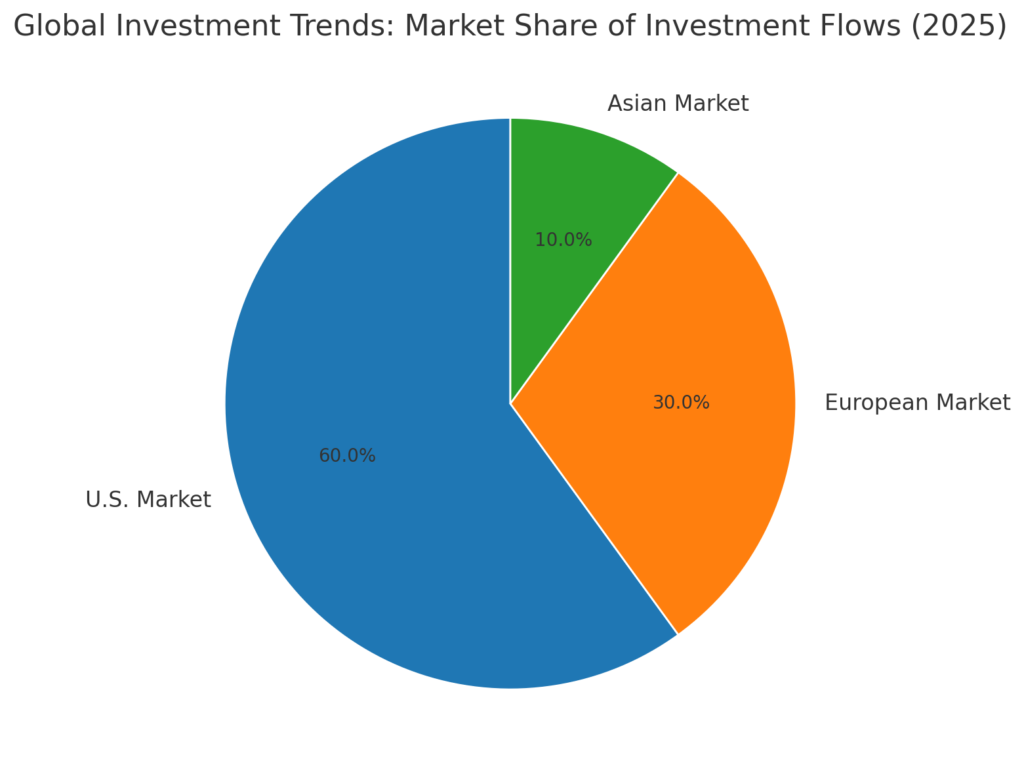

The global investment landscape is seeing a major transformation. Many investors are diversifying away from U.S. markets due to:

- Overvaluation of U.S. Stocks: Nearly 90% of investors consider U.S. equities overvalued, according to a Bank of America survey.

- Increased European Investments: The shift to European equities is the largest in 25 years, as global investors seek stable returns outside the U.S.

Comparison of Investment Trends (Table)

| Investment Type | U.S. Market | European Market |

|---|---|---|

| Equity Holdings | Declining | Increasing |

| Market Stability | High Volatility | Growing Confidence |

| Investor Sentiment | Overvalued | Attractive Valuations |

2. Economic Growth and Policy Changes: A Two-Speed Economy

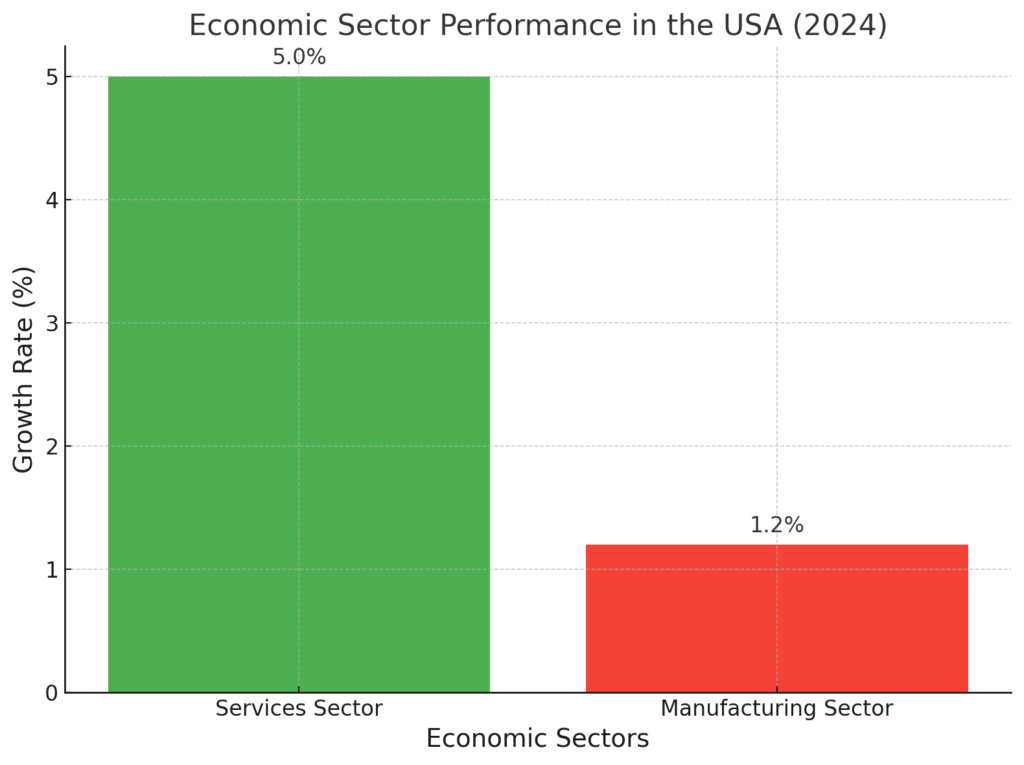

The U.S. economy is experiencing mixed growth:

- Services Sector: Thriving due to robust order books and positive business sentiment for 2025.

- Manufacturing Sector: Facing challenges, with slower growth and less optimism.

Key Data:

- Service Sector Growth: Over 5% growth in late 2024.

- Manufacturing Struggles: Only 1.2% growth in the same period.

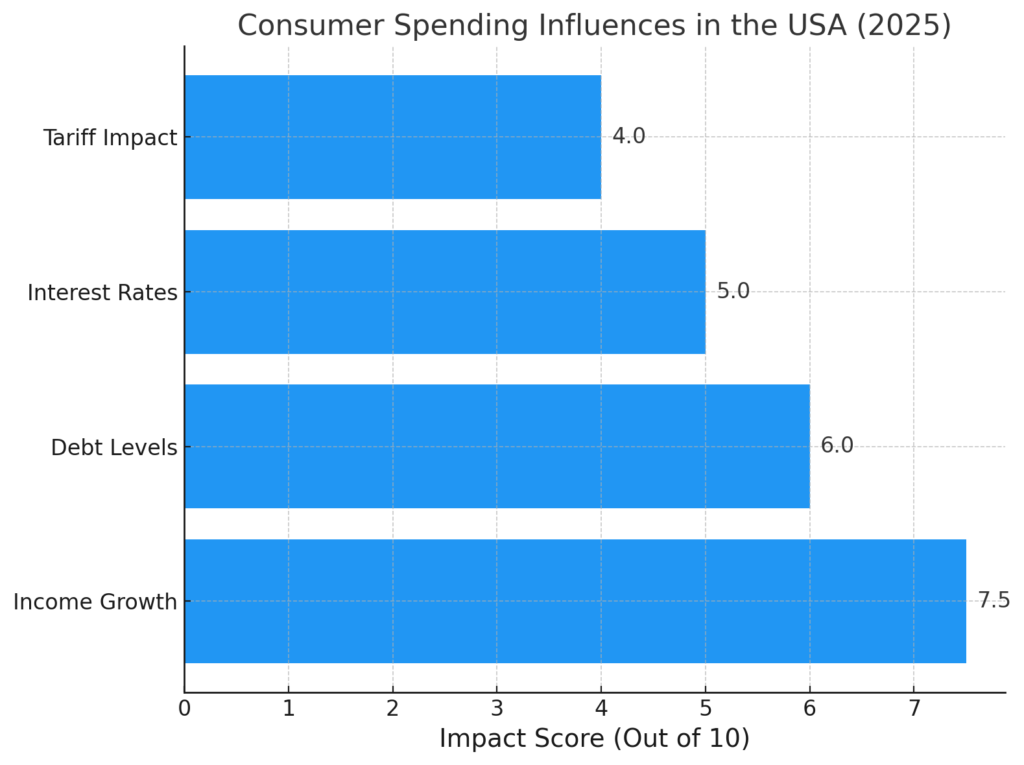

3. Consumer Spending and Inflation Dynamics

Consumer spending remained strong through 2024, with a 3.7% increase driven by durable goods purchases. However, rising household debt and potential future tariffs could impact this trend.

How This Shift Affects You

For Investors:

Diversification is key. With U.S. equities overvalued, exploring international markets could reduce risks and enhance returns. Keeping an eye on emerging markets like Europe and Asia is advisable.

For Consumers:

Maintaining a balanced budget will be crucial as inflation and tariffs affect the cost of goods. Reducing high-interest debt and building emergency savings can provide financial stability.

For Businesses:

Adaptability is vital. Manufacturing companies may need to innovate or find new markets, while service-oriented businesses can capitalize on current growth trends.

Visual Insights: Mind Map of the Economic Shift

Record-Breaking Economic Shift in the USA

|

-------------------------------------------------

| | |

Investment Trends Economic Growth Consumer Spending

| | |

| Services Sector Debt Levels

European Markets (Growing) (Increasing)

(Attractive) | |

| Manufacturing Inflation Impact

| (Struggling) (2026 Tariffs)

Global Diversification |

Policy Changes

(America First)

Conclusion: Preparing for the Economic Future

The Record-Breaking Economic Shift in the USA is not just a temporary change but a sign of a broader economic transformation. By staying informed and making strategic financial choices, you can navigate these shifts with confidence and security. Whether you’re an investor, consumer, or business owner, adaptability and foresight will be your strongest assets.