Government Shutdown Averted: Last-Minute Deal Sparks Backlash—What It Means for Your Wallet

In a high-stakes political showdown, a last-minute deal has averted a government shutdown, but the agreement has ignited fierce backlash from lawmakers and citizens alike. While the immediate crisis has been avoided, the ripple effects on taxpayers, federal workers, and the U.S. economy are far from over. This blog dives deep into the details of the deal, its financial implications for you, and why it’s already trending across the nation. Plus, we’ll explore how this impacts your wallet and what it means for the future of the U.S. economy.

Table of Contents

The Last-Minute Deal: What You Need to Know

With just hours to spare before the midnight deadline, Congress passed a temporary funding bill to keep the government running. This stopgap measure, however, has left many frustrated. Critics argue that it’s a Band-Aid solution that fails to address long-term fiscal challenges, while supporters claim it was necessary to prevent economic chaos.

The deal funds federal operations for the next 45 days, but it sidesteps contentious issues like healthcare reforms, defense spending, and tax policies. This has sparked outrage from both progressive and conservative groups, who accuse lawmakers of prioritizing political survival over meaningful solutions.

What It Means for Your Wallet

While the immediate threat of a shutdown has been avoided, the deal’s impact on your finances is nuanced. Here’s a breakdown of what you need to know:

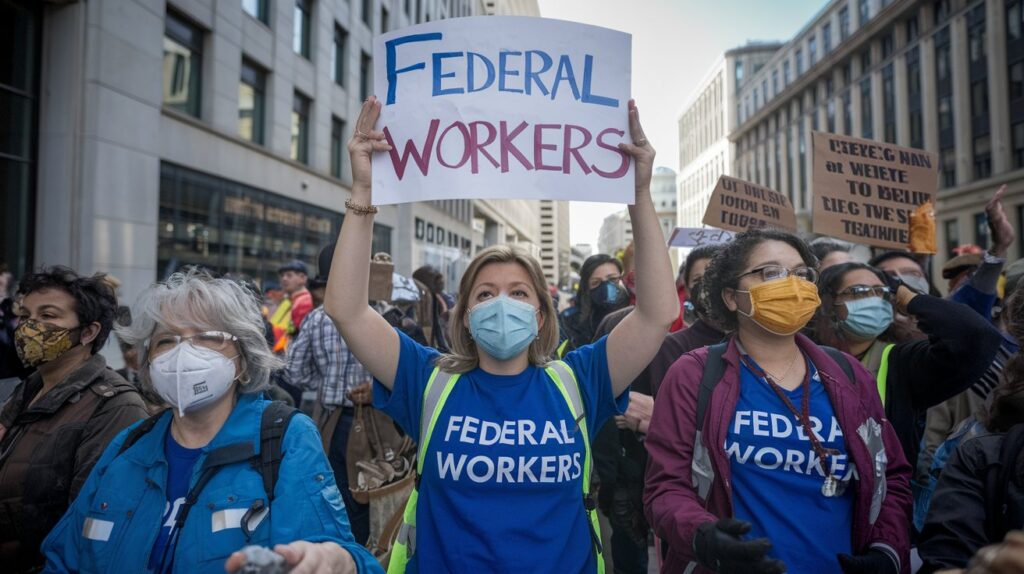

- Federal Workers and Contractors: Over 2 million federal employees and countless contractors can breathe a sigh of relief, as their paychecks are safe—for now. A shutdown would have delayed wages, causing financial strain for many families.

- Taxpayers: The deal doesn’t include any major tax reforms, so your tax obligations remain unchanged. However, the lack of a long-term budget plan could lead to future tax hikes or spending cuts.

- Economic Stability: A shutdown would have disrupted markets, potentially causing losses for investors and retirees. The deal provides temporary stability, but the uncertainty surrounding future negotiations could still rattle the economy.

- Inflation and Debt: Critics warn that short-term deals like this one could worsen the national debt and inflation, indirectly affecting consumers through higher interest rates and increased costs of living.

Conclusion

The last-minute deal to avert a government shutdown may have provided temporary relief, but its long-term implications for taxpayers, federal workers, and the U.S. economy remain uncertain. By staying informed and understanding how this impacts your wallet, you can better navigate the financial challenges ahead. [USnewsSphere.com]