Trump’s plan to ban institutional investors from buying single-family homes is set to shake up the U.S. housing market and could finally bring the long-promised “American Dream” of homeownership back to everyday families. This bold move — coupled with California Governor Gavin Newsom’s crackdown on corporate landlords — places housing affordability at the forefront of national and state policy debates. Analysts, homeowners, and investors alike are watching closely as these developments could reshape how homes are bought, sold, and owned across the country.

Trump’s Ban on Institutional Home Buying: A Game Changer

President Donald Trump announced a proposal to ban large institutional investors — such as private equity firms and major rental companies — from purchasing single-family homes, arguing that corporate ownership drives up prices and limits access for middle-class buyers. His administration claims this policy will reopen opportunities for families who have been sidelined by Wall Street money flooding the market.

Trump’s announcement, made via social media and through remarks to supporters, has already sent shockwaves through financial markets. Major publicly traded real estate investment trusts (REITs) and institutional landlords like Blackstone, Invitation Homes, and American Homes 4 Rent saw significant stock price declines shortly after the news broke — reflecting investor concern over the potential disruption to their business models.

Supporters of the ban argue it could help cool soaring housing costs and restore balance to a market where buyers with deep pockets have frequently outbid ordinary families. They point to data showing that institutional buyers, while a relatively small portion of the entire market, have grown more active over the past decade, particularly in key metro areas where affordability has plummeted.

However, some economists caution that institutional investors own a small percentage of single-family homes nationally — estimates range around 1 percent — suggesting that while symbolic, the policy alone may not fix the nation’s deep-rooted supply problems. Critics also warn that limiting investor participation could reduce capital available for housing development, potentially slowing construction and keeping prices elevated.

California’s Parallel Fight: Newsom Targets Corporate Landlords

At the same time, California Governor Gavin Newsom has signaled his own effort to rein in big investors in the state’s housing market. In his State of the State address, Newsom announced plans to enhance oversight and potentially change the tax code to discourage corporate landlords from buying up large inventories of housing that could otherwise go to local residents.

This policy approach marks a shift for the governor, who has traditionally focused on increasing housing supply through permitting and zoning reforms. Newsom’s new stance embraces some of the same rhetoric as the Trump administration — blaming Wall Street for worsening affordability — while also staying rooted in California’s unique housing challenges.

Unlike Trump’s outright ban, Newsom’s proposals aim to curb rather than prohibit large investor activity. He’s seeking legislative support to give the state broader powers to regulate corporate landlords and push for accountability in how homes are bought and rented.

While some housing advocates welcome any effort to slow investor buying, others say Newsom’s strategy may not solve California’s chronic affordability problems. They argue that without dramatically increasing new home construction, even stricter investor limits won’t make homes substantially cheaper for everyday buyers.

Market Reaction and Economic Impact

Financial markets reacted sharply to these housing policy announcements. Major real estate sector stocks fell as investors digested the news and adjusted expectations for future business prospects. For instance, companies heavily involved in single-family rentals and property investment saw declines across the board.

Economists note that this volatility reflects deeper uncertainty about how the housing market could change. Big investors often bring large pools of capital that help finance construction and property improvements — functions that could be disrupted if their role is sharply curtailed. At the same time, reducing competition from deep-pocketed institutional buyers might lower barriers for smaller buyers who depend on mortgage financing rather than all-cash offers.

The policies also sparked debate among lawmakers; some see bipartisan potential in curbing corporate ownership of homes, while others argue that the proposals could have unintended consequences. For example, if institutional capital retreats, traditional lenders and smaller developers might be less willing to build new housing without clear profit incentives.

Housing Affordability: A Broader Problem

While Trump and Newsom’s policies zero in on Wall Street’s involvement in home buying, many experts emphasize that the core issue remains a shortage of housing supply nationwide. Home prices have surged dramatically over the past decade, driven largely by low inventory and strong demand. Even in states with aggressive housing production laws like California, supply has not kept up with population growth, pushing prices out of reach for many young buyers.

In California, recent housing legislation has focused on easing environmental review hurdles and expanding zoning near transit to accelerate construction of new homes, part of efforts to deliver millions of new units by 2030. These reforms include exemptions under the California Environmental Quality Act and density bonuses to encourage more multifamily development.

Yet even with these regulatory tools, construction costs, labor shortages, and community resistance continue to slow progress. Some state and local leaders argue that without substantial public funding to build affordable units, market forces alone won’t produce enough homes to significantly lower prices.

Political Dynamics and Public Perception

The timing of these housing initiatives — from both a Republican White House and a Democratic California governor — illustrates the growing political salience of housing affordability. For years, Democrats have criticized institutional investors for pushing up prices and reducing opportunities for first-time buyers, while Republicans have emphasized market access and homeownership as key to economic stability. Now, both sides are converging on a shared critique of big money’s influence in housing.

This convergence could have implications beyond housing, shaping voter perceptions ahead of upcoming elections. Affordable housing continues to be a top concern for middle-class families, and policymakers from across the political spectrum are under pressure to show they can make meaningful change.

At the same time, housing experts caution that blaming institutional investors alone may oversimplify the issue. The real challenge, they say, lies in structural problems: decades of underbuilding, zoning restrictions, and insufficient infrastructure investment that prevented new communities from forming.

What Comes Next for U.S. Housing

If Trump’s ban on institutional buyers becomes law — either through Congressional action or executive policy — it would mark one of the most significant federal interventions in the housing market in decades. The proposal is expected to bring further debate and legislative negotiations over how to balance investor presence with affordability goals.

Similarly, Newsom’s proposals in California could inspire other states to consider similar corporate landlord regulations, particularly in high-cost regions where housing has become a political flashpoint. This may ultimately lead to a patchwork of state-level housing policies that vary widely depending on local market conditions and political priorities. CalMatters

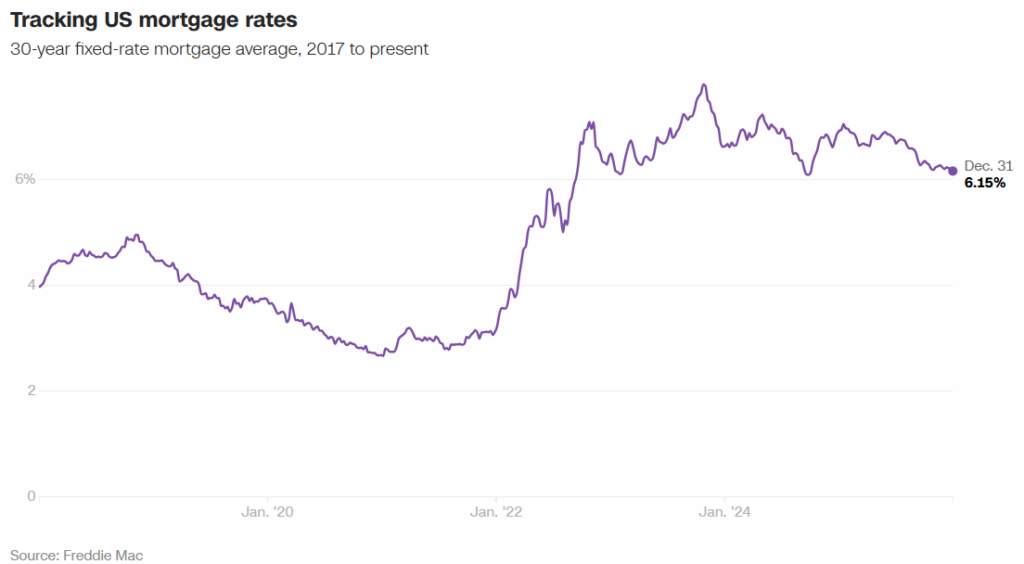

Housing analysts will be watching the next phases of these initiatives closely, especially as economic data around inventory, mortgage rates, and rental trends continue to evolve. With home prices still elevated and demand strong, the pressure on policymakers to deliver real solutions remains intense.

Conclusion: A Defining Moment for American Homeownership

Trump and Newsom’s recent housing policy moves represent a rare moment of cross-ideological attention to the nation’s housing affordability crisis. While their approaches differ, both leaders are responding to widespread public frustration over rising costs and limited opportunity for everyday buyers.

Whether these proposals translate into meaningful change will depend on legislative action, economic responses, and continued public engagement. What is clear, however, is that housing remains at the center of the American economic story — and that policymakers at all levels are now confronting issues that millions of families grapple with daily.

Subscribe to trusted news sites like USnewsSphere.com for continuous updates.