How the $38.3 Billion ICE Detention Expansion Could Impact U.S. Federal Spending, Private Contractors, and Taxpayer Costs is one of the most consequential government policy shifts in recent U.S. history. The plan would fundamentally reshape the federal government’s immigration enforcement infrastructure and spending priorities while increasing the role of private prison contractors and imposing long-term costs on taxpayers.

This matters now because federal policymakers have allocated tens of billions under the One Big Beautiful Bill Act, approving unprecedented funding for immigration enforcement, including the massive expansion of detention capacity, at a time of intense political debate over immigration policy.

ICE Detention Expansion: Core Explanation

A Massive Expansion of ICE Infrastructure

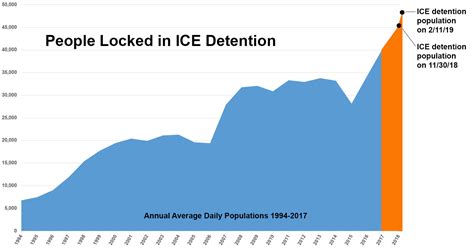

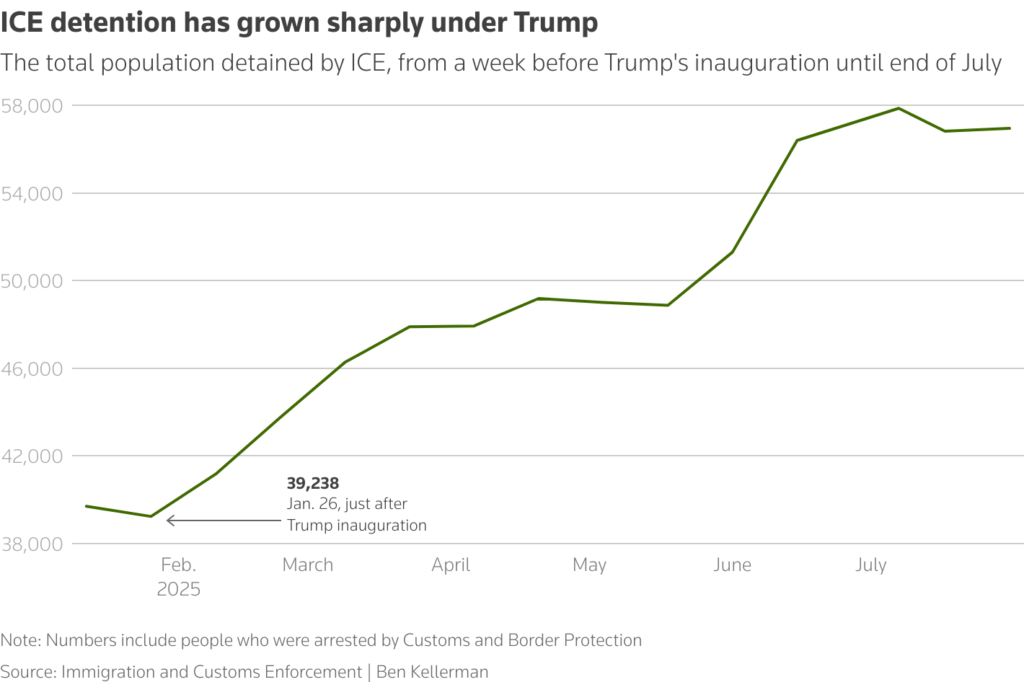

The U.S. Immigration and Customs Enforcement (ICE) has unveiled a plan to spend $38.3 billion on a sweeping initiative to expand detention capacity nationwide. This effort would nearly double existing bed space and create a network of large-scale detention and processing facilities.

The funding comes largely from the One Big Beautiful Bill Act, a congressional package that significantly boosted spending for border and immigration enforcement, including enhancing deportation capacity. Under this plan, ICE aims to buy, retrofit, and build new facilities, converting warehouses into detention centers capable of holding tens of thousands of people.

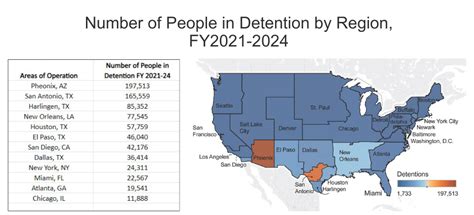

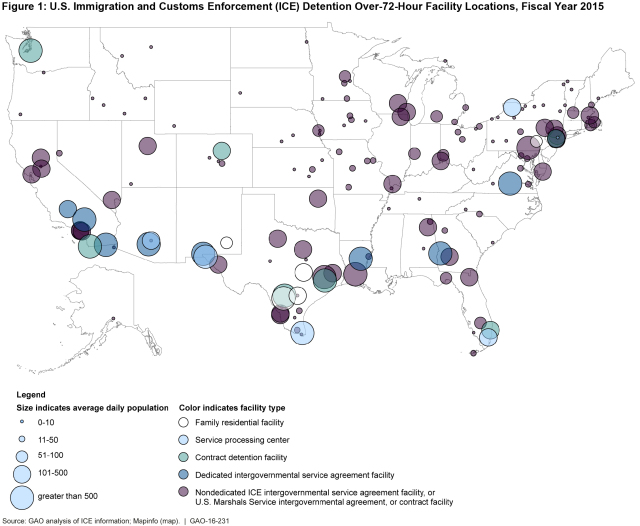

ICE’s own documents detail that the new network will include 16 regional processing centers and eight large detention facilities, along with the acquisition of 10 existing “turnkey” sites, increasing total capacity to around 92,600 beds.

How It Works / Step-by-Step

Step 1: Funding and Legislative Authorization

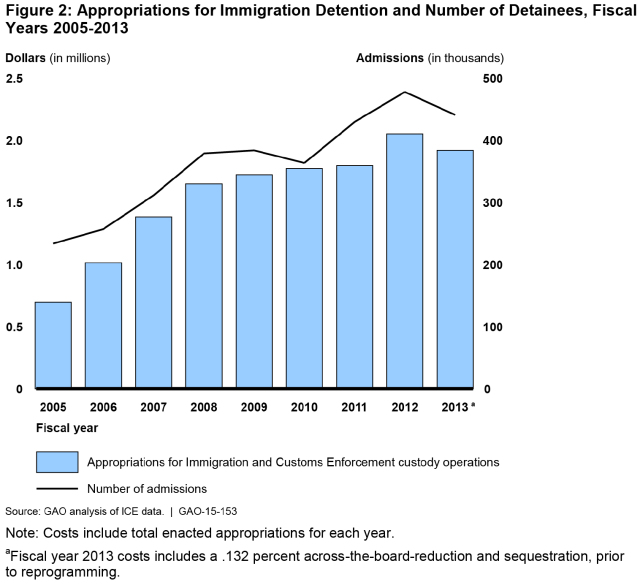

Congress allocated the $38.3 billion component through a major spending package focused on immigration enforcement. This redirected federal resources toward detention expansion when budget priorities were under debate.

Step 2: Identification and Acquisition of Sites

ICE will purchase or lease existing structures across multiple states, such as warehouses, which will be converted into processing centers and detention facilities. Several facilities have already been acquired quietly, prompting public pushback and legal challenges.

Step 3: Renovation and Construction Contracts

Private firms — especially large correctional facility contractors — will execute renovations, build medical and administrative spaces, install security infrastructure, and adapt utilities. These contracts will create new revenue sources for companies traditionally tied to prison construction and maintenance.

Step 4: Staffing and Operations

ICE plans to pair the expanded infrastructure with a surge in staffing, including enforcement officers and detention personnel. This will generate operating expenses that continue year-over-year, often funded from annual federal appropriations.

Benefits and Risks

Benefits Cited by Supporters

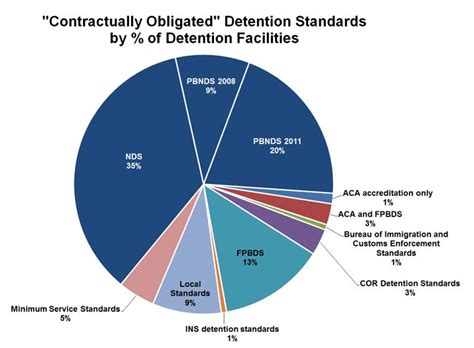

Proponents argue that expanded facilities will streamline the detention and removal process, reduce reliance on temporary contracts, and centralize operations. The administration claims it can manage detainees more humanely and efficiently in stable facilities than in scattered local jails.

Supporters also point to potential economic boosts in regions hosting new facilities, as construction and operations may support jobs and local services.

Risks to Public Finance

However, the $38.3 billion price tag carries major risk to federal budgets, as ongoing operational costs could exceed initial projections and require sustained appropriations. Critics warn that the government may face higher than expected maintenance costs, healthcare expenses for detainees, and legal liabilities tied to detention conditions.

There are also serious legal and human rights concerns — millions in federal court rulings have found ICE detained people illegally, creating potential liability and additional costs.

Financial Impact or Cost Breakdown

Federal Spending Shift

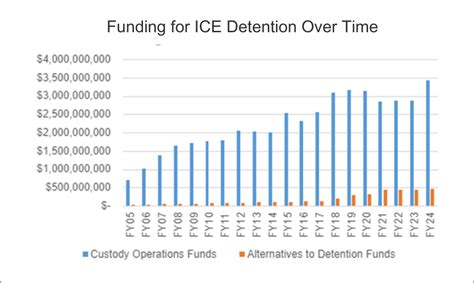

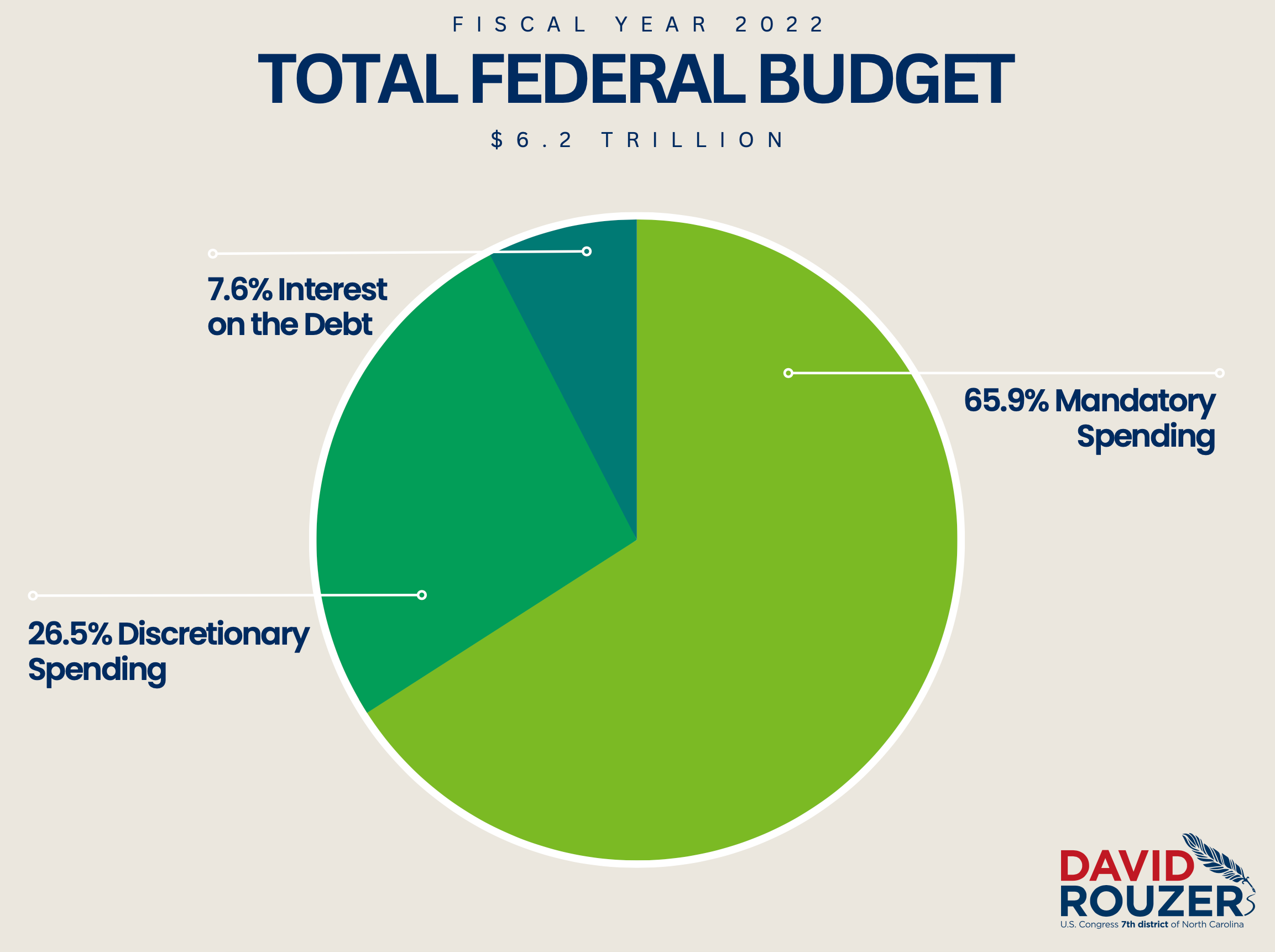

The $38.3 billion expansion accounts for a fraction of the broader $170 billion immigration enforcement budget approved by Congress. Within that, nearly $45 billion targets detention infrastructure and operations.

Facility Conversion Costs

Estimates of individual facility costs are significant. For example, the proposed Merrimack, New Hampshire, processing facility is projected to cost more than $158 million to retrofit and another $146 million to operate over three years.

Contractor Revenue Gains

Large private detention contractors are anticipated to benefit. In 2025, companies like GEO Group and CoreCivic reported revenues exceeding $2 billion each, largely supported by ICE contracts. These firms may see continued growth as federal spending expands.

Long-Term Operational Costs

Beyond construction, annual operating expenses — staff salaries, utilities, medical services, security, and legal compliance — represent recurring taxpayer obligations. Over a decade, these could total multiples of the initial capital outlay.

Comparison: Alternatives to Detention Expansion

Some policy analysts argue that alternatives to detention — such as electronic monitoring or community-based programs — can be far more cost-effective. These alternatives often cost a fraction of traditional detention while reducing legal liabilities and improving compliance outcomes.

Compared to expanded detention centers, community-oriented programs typically incur lower per-person monthly costs, freeing budget for other needs like immigration court support.

Expert Tips or Best Strategies

Focus on Cost Transparency

Policymakers should mandate regular public reporting on construction and operating costs to prevent budget overruns.

Evaluate Alternatives

Consider expanding alternatives, such as GPS monitoring or supervised release, where appropriate, to reduce taxpayers’ exposure to high operational costs.

Assess Long-Term Fiscal Impact

Budget analysts should project long-term spending across 10–20 year horizons to ensure sustainability and guard against unexpected deficits.

Frequently Asked Questions (FAQ)

What is the ICE detention expansion plan?

The plan involves $38.3 billion in federal spending to acquire, retrofit, and build detention facilities across the U.S. to expand ICE’s detention capacity to roughly 92,600 beds.

How is the expansion funded?

Funding is drawn from the broader One Big Beautiful Bill Act, which redirected significant federal resources toward immigration enforcement.

Who benefits financially from the expansion?

Private prison and detention contractors, especially large firms with government contracts, are expected to benefit from construction and operations.

What does this mean for taxpayers?

Taxpayers will shoulder not only the initial capital costs but also long-term operational expenses, which could become billions annually.

Will this policy reduce immigration?

The expansion is intended to support increased enforcement and deportations, but its actual effect on immigration flows and illegal crossings remains a subject of debate.

Are there legal challenges linked to the expansion?

Yes. Many cities and states have opposed new facilities, and court rulings have found unlawful detentions, raising prospects for legal challenges and added costs.

The $38.3 billion allocation for ICE detention expansion marks one of the most ambitious shifts in U.S. immigration policy and spending. Its effects stretch beyond detention buildings to federal budgeting, contractor revenues, and taxpayer responsibilities.

While supporters see operational efficiencies and enforcement gains, critics highlight long-term fiscal risks, legal liabilities, and questionable effectiveness compared to alternatives.

Ultimately, the policy raises critical questions about the role of incarceration in immigration enforcement and how the federal government should balance security, cost, and civil liberties in a complex, high-stakes arena.

Subscribe to trusted news sites like USnewsSphere.com for continuous updates.