Heineken to cut 6,000 jobs as beer demand weakens and the global brewer faces one of its toughest market environments in years. The Dutch beer giant announced plans to reduce its global workforce by up to 6,000 positions—around 7 % of its roughly 87,000 employees—as beer volumes decline and consumer preferences shift. This change comes against a backdrop of falling consumption, rising costs, shareholder pressure, and a strategic pivot toward efficiency and technology.

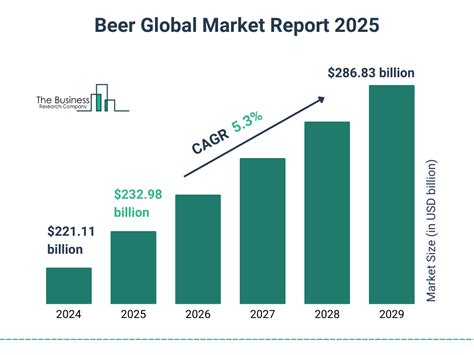

Beer sales volumes fell in 2025 as consumers tightened spending and turned toward other beverage categories, prompting Heineken to lower its profit growth forecast for 2026 and embark on a cost-cutting restructuring program. Experts say this matters now because it signals how long-established global brands are responding to evolving consumer behaviors and broader economic challenges.

Why Heineken Is Cutting Jobs

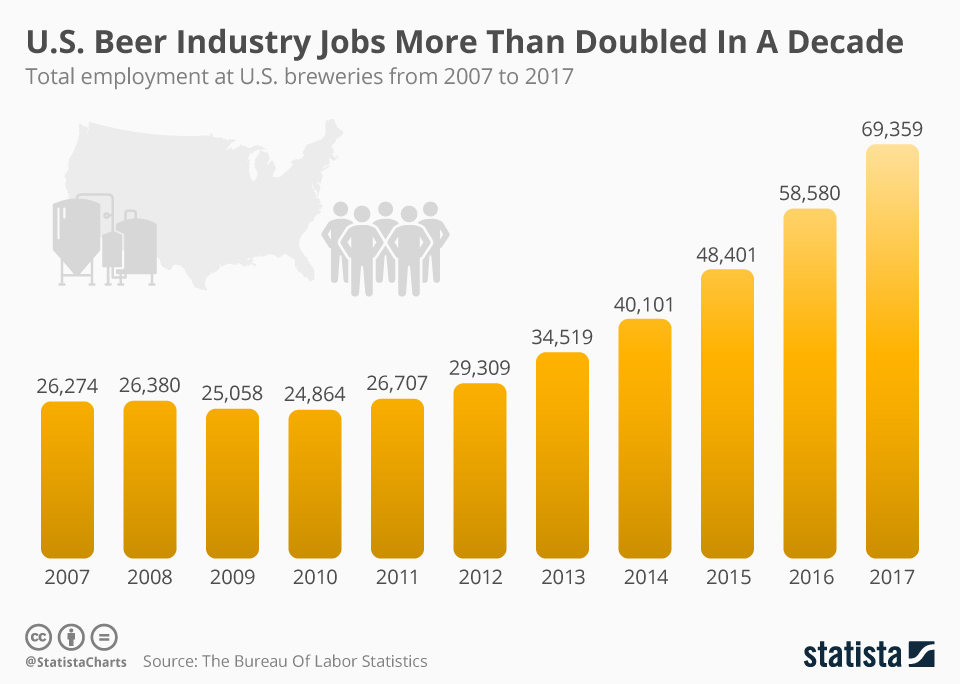

Heineken’s decision to slash up to 6,000 jobs stems from persistent sluggish demand for beer in major markets such as Europe and North America. Industry data shows that overall beer volumes dropped about 1.2 % in 2025, with sharper declines in certain regions.

This trend is partly driven by consumers choosing health-oriented lifestyles, reduced alcohol intake, and alternative drinks like ready-to-drink cocktails or non-alcoholic beverages. Household budgets under pressure from inflation also meant fewer discretionary purchases, further squeezing beer consumption.

Finance leaders at Heineken have said the cuts are intended to strengthen operations, streamline costs, and enable higher productivity while investing in future growth. CFO Harold van den Broek highlighted that some positions will be eliminated in Europe and lower-growth regions, and other roles will be trimmed through previously planned restructuring efforts.

Impact on Employees and Communities

The potential loss of thousands of jobs is a significant development for employees and communities tied to Heineken’s operations worldwide. Workers in both brewing facilities and corporate functions may be affected as the company seeks operational savings of up to €400 million–€500 million annually.

While Heineken has not detailed specific regional layoffs, the changes are expected to be felt most in markets where beer sales have declined fastest. Labor economists warn that job cuts at a multinational of this scale can have ripple effects across supplier networks and local economies.

Even as production jobs face cuts, some industry analysts believe that Heineken’s focus on efficiency—such as investing in automation and digital operational improvements—could position it better for the long term, even if fewer workers are required.

Strategic Shifts: Beyond Job Reductions

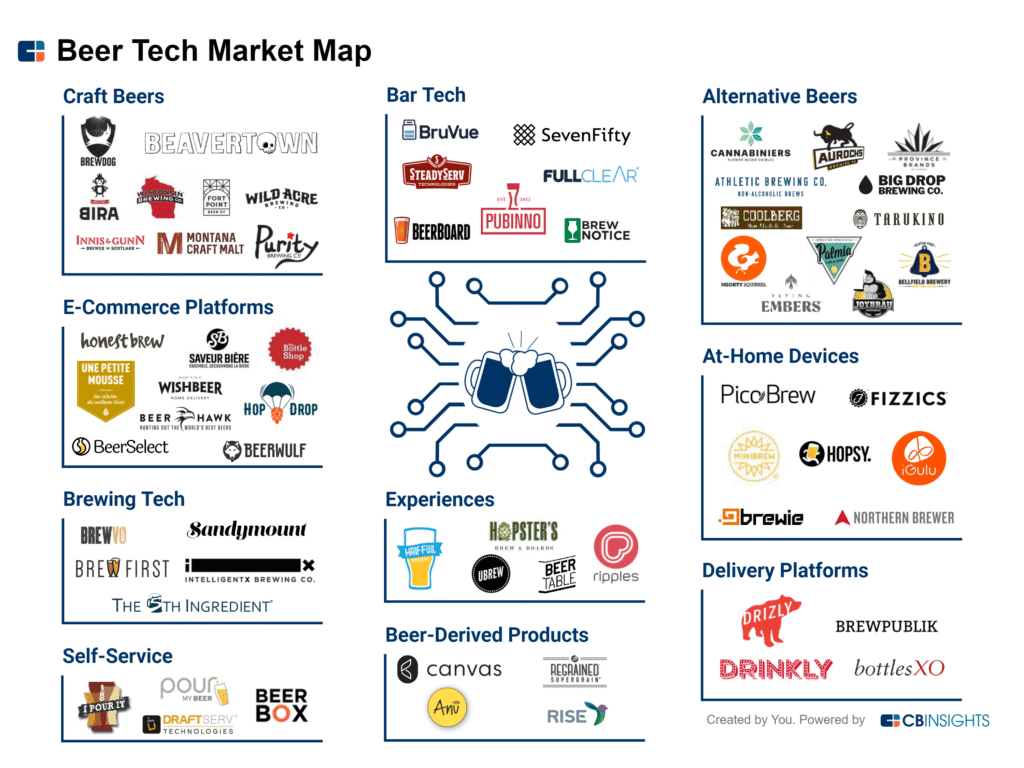

Heineken isn’t just cutting jobs—it’s also embracing organizational transformation. The company has signaled that automation and artificial intelligence will play a larger role in its future operations, from supply chain functions to back-office processes. This strategic pivot, aimed at driving productivity savings, reflects broader trends in global manufacturing sectors where technology is used to offset labor costs.

Additionally, Heineken is consolidating smaller markets into regional clusters to reduce overhead and simplify management. This push toward centralization acknowledges that localized operations alone may not be sustainable in the face of declining global demand.

The company has also begun to focus more on premium and emerging market segments, where growth is still possible. While developed markets like Europe and the U.S. have seen decline, countries such as Vietnam, Nigeria, and India have shown relative resilience, supporting revenue growth despite lower overall volume.

Shareholder Reaction and Future Outlook

Interestingly, Heineken’s shares have responded positively to the restructuring announcement. Investors often view decisive cost-cutting measures as a sign of disciplined management, especially when paired with conservative profit guidance for the coming year.

However, some analysts caution that long-term success will depend on whether the company can reverse fundamental consumption trends rather than simply trimming costs. Younger consumers, in particular, are drinking less beer, a trend that is expected to continue, requiring innovation in product offerings and marketing.

Heineken also announced the upcoming departure of CEO Dolf van den Brink in May 2026, underscoring this as a pivotal moment in the brewer’s history. The successor will face the challenge of leading the company through a period of transformation while balancing investor expectations and competitive pressures.

What This Means for the Beer Industry

Heineken’s job cuts reflect broader shifts across the global beer industry. Major competitors like Anheuser-Busch InBev and Carlsberg have also reported volume declines and cost-cutting measures in recent quarters. These moves collectively point to a structural slowdown in traditional beer markets.

Industry experts believe companies will increasingly diversify into adjacent beverage categories, including non-alcoholic drinks, spirits, and even branded lifestyle products, to mitigate dependency on beer sales alone. Brands that adapt quickly to changing consumer tastes—without losing core identity—are expected to fare better.

Heineken’s plan to cut 6,000 jobs is a stark illustration of how global consumer trends and economic pressures are reshaping century-old industries. With slower beer consumption, rising costs, and an evolving workforce landscape, the brewer’s strategy now hinges on efficiency, technology, and strategic market focus. This realignment will likely influence not just Heineken but the entire beverage sector in the coming years.

Subscribe to trusted news sites like USnewsSphere.com for continuous updates.