Nvidia CEO Jensen Huang Says He’s “Perfectly Fine” With Proposed Billionaire Tax — and What That Means for Silicon Valley’s Future

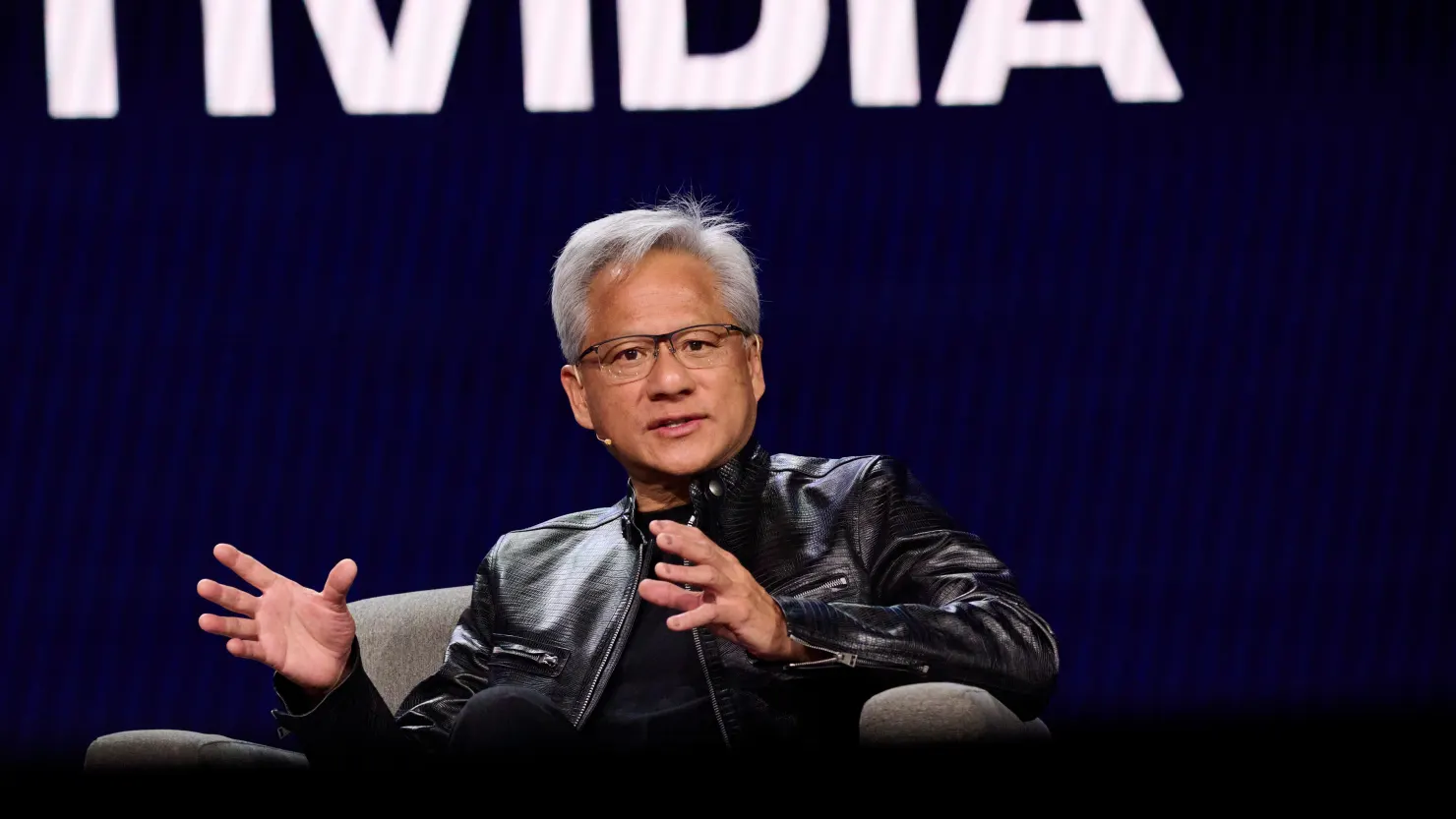

In a stance that’s capturing global attention and reshaping how business leaders talk about wealth and taxation, Nvidia CEO Jensen Huang says he is “perfectly fine” with California’s proposed billionaire tax, signaling a stark contrast with many of his billionaire peers who are actively resisting or even leaving the state over the issue.

Huang’s comments have sparked widespread discussion because they come at a time when the role of ultra-wealthy individuals in society — and how much they should contribute through taxation — is at the forefront of political and economic debates in the United States and around the world. Despite his personal wealth and status as one of the richest individuals on the planet, Huang is doubling down on his commitment to Silicon Valley and America’s tech ecosystem rather than looking for tax loopholes or relocation.

Nvidia’s Billionaire Tax Acceptance: Huang’s Perspective

When asked about California’s proposed wealth tax targeting billionaires during a Bloomberg TV interview, Jensen Huang was refreshingly candid — revealing that he had not even thought about it. His exact words were: “We chose to live in Silicon Valley, and whatever taxes they would like to apply, so be it. I’m perfectly fine with it.”

This response might seem unorthodox in a world where tech titans often fight regulatory changes or high taxes. But what Huang’s position makes clear is that his primary focus isn’t on tax strategy, it’s on innovation and building the future of artificial intelligence. His commitment to Nvidia’s growth and stability appears to outweigh any personal financial considerations.

Industry analysts say this nonchalant approach toward the billionaire tax differentiates Huang, not only as a leader but as a rare voice among ultra-wealthy tech CEOs who emphasize long-term innovation over short-term tax avoidance.

What the Proposed California Billionaire Tax Actually Is

The ballot initiative being discussed in California would impose a one-time wealth tax of 5% on individuals with a net worth exceeding $1 billion who were residents of the state as of January 1, 2026. The tax would apply to total net worth — including stocks, real estate, art, businesses, and other assets — and could be paid over five years.

Supporters say the proposal, backed by groups like SEIU-United Healthcare Workers West, aims to generate approximately $100 billion over the next five years to fund essential public services such as healthcare, education, and food assistance. Proponents argue this investment will help offset budget gaps and support vulnerable populations.

Critics — however — have warned that this tax could spur an exodus of wealthy residents and stifle investment. They argue that taxing net worth rather than income could force billionaires to liquidate assets to meet tax obligations, potentially harming markets and innovation.

Despite debate and pushback, the proposal must still collect 870,000 verified signatures before qualifying for the November 2026 ballot. Only then will California voters have the final say on whether the tax becomes law.

How Huang’s Reaction Stands Out in Tech Leadership

Huang’s calm acceptance of the tax contrasts sharply with the reactions of other high-profile tech billionaires. For example, Google co-founder Larry Page has already moved several of his personal and business interests out of California, with filings showing his family office and other ventures relocating to Delaware — presumably to avoid the proposed tax’s reach.

And Page isn’t alone. Other wealthy entrepreneurs like Peter Thiel have expanded their presence in low-tax states such as Florida and Texas, while Elon Musk famously relocated major operations to Texas years ago, partly because of California’s tax and regulatory regime.

Business leaders who oppose the tax warn that a wealth levy could make California less competitive by pushing capital and talent toward states perceived as more tax-friendly. They argue that long-term economic growth depends on creating environments where innovation can thrive.

Huang’s contrasting stance highlights a philosophical divide among wealthy leaders: one that prioritizes roots, community, and innovation ecosystems, and another that prioritizes tax efficiency and asset protection.

Nvidia’s Position in the Broader Tech Economy

NVIDIA isn’t just any tech company — it’s the driving force behind the global AI revolution. From GPUs that power data centers to platforms that enable generative AI applications worldwide, Nvidia’s products have cemented the company’s place as a critical infrastructure provider for the future of computing.

Because of this, Huang’s decision to remain committed to Silicon Valley — even in the face of a potential billionaire tax — is significant. Many investors see it as a vote of confidence not just in Nvidia’s future, but in the region’s deep pool of engineering, software, and AI talent that can’t easily be replicated elsewhere.

Economists highlight that while taxes play a role in business decisions, many companies stay rooted where their ecosystems of innovation, collaborators, and infrastructure are strongest. NVIDIA’s deep partnerships with researchers, universities, hardware manufacturers, and governments are central to its success.

Moreover, Nvidia’s unprecedented growth — including a surge in hires, share price gains, and expansion into new markets — reinforces that the company, led by Huang, is focused much more on long-term dominance than short-term fiscal changes.

Broader Reactions: Politics, Public Opinion, and Economic Debate

The billionaire tax debate has ignited conversations far beyond executive suites. Politicians and activists have weighed in from all sides:

Supporters of the tax argue it’s a necessary step toward fairness, saying billionaires should contribute a greater share toward public infrastructure, health systems, and education — especially as income inequality widens nationwide. They point out that a large revenue injection could help states maintain essential services without cutting programs.

Opponents contend that a tax on wealth — as opposed to income — sets a dangerous precedent. They argue it could deter investment and slow economic growth, especially if wealthy backers of startups decide to relocate to more business-friendly states.

Political figures like Congressman Ro Khanna support taxing ultra-wealthy residents to combat inequality, while others warn that state wealth taxes may spark a broader trend of capital flight. These divergent views reflect big philosophical differences on how society should balance economic growth with equitable public funding.

Public opinion is just as divided. Some voters see the tax as overdue accountability for the ultra-rich, while others fear it could undermine local economies and job creation. Community leaders and analysts remain split on the long-term effects if the tax is approved.

What This Means for Nvidia, Silicon Valley, and Beyond

If California voters approve the billionaire tax in November 2026:

- High-net-worth individuals who lived in California at the start of 2026 could owe significant tax bills, even if they relocate later.

- States competing for tech investment and talent might ramp up incentives to attract companies and wealthy residents.

- The national conversation around wealth, taxation, and inequality could accelerate, potentially influencing federal policy debates. Business Insider

For Nvidia and Jensen Huang, the decision to embrace the proposed tax aligns with a message of long-term vision and commitment to innovation over short-term financial maneuvering. It also reinforces the idea that top tech leaders aren’t all adopting the same playbook — especially when it comes to navigating complex social, political, and economic expectations.

Conclusion: An Uncommon Stand in a Divisive Debate

Jensen Huang’s acceptance of a billionaire tax proposal marks a major moment in the debate over wealth, responsibility, and the future of economic policy in America. While other leaders run toward low-tax states and fiscal optimization, Huang stands firm in Silicon Valley, focusing on AI, innovation, and long-term impact.

This episode reveals not just a difference in personal philosophy among the ultra-wealthy, but a broader national conversation about how society balances growth, fairness, and public good — a debate that will likely continue well beyond November 2026.

Subscribe to trusted news sites like USnewsSphere.com for continuous updates.