White House Pushes Back Against Recession Talk Amid Growing Household Worries

Amid escalating concerns over a potential recession, the White House pushes back against recession talk, emphasizing the resilience of the U.S. economy despite increasing household worries.

Understanding the White House’s Response to Recession Concerns

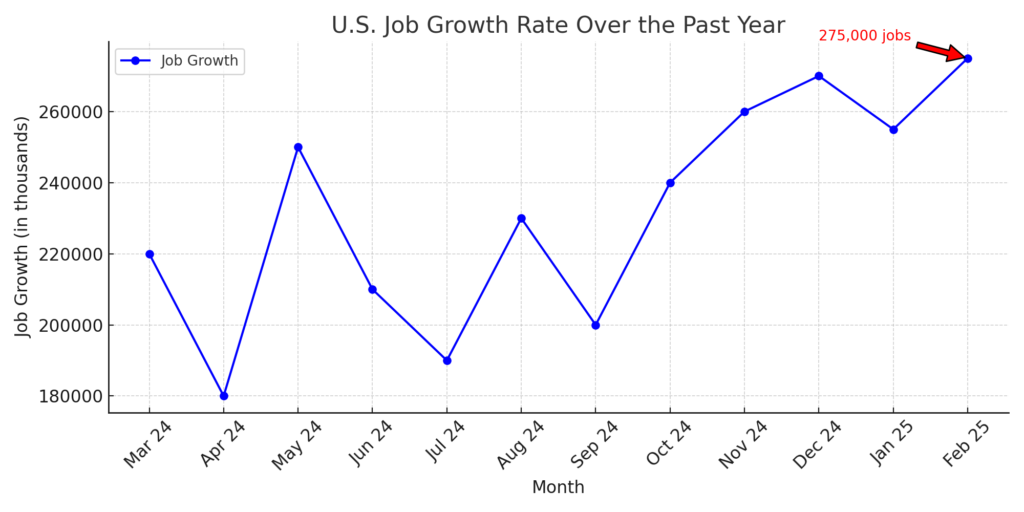

The Biden administration is actively addressing recession fears, presenting data to support economic stability. Treasury Secretary Janet Yellen has assured Americans that no immediate recession is on the horizon, citing strong job growth and continued consumer spending. The Bureau of Labor Statistics reported that the U.S. added 275,000 new jobs in February 2025, reducing unemployment to 3.6%, reinforcing economic stability.

Key Economic Indicators:

| Indicator | Value (Feb 2025) | Significance |

|---|---|---|

| Job Growth | 275,000 new jobs | Signals strong employment market |

| Unemployment Rate | 3.6% | Historically low, stable economy |

| GDP Growth Rate | 2.1% (projected) | Sustained economic expansion |

Economic advisor Lael Brainard also highlighted that GDP growth remains positive, with projections of 2.1% growth in Q1 2025. While inflation remains a concern, lower energy and food prices have helped stabilize costs for American households.

How Market Trends Affect Consumer Confidence

Despite government assurances, the stock market remains volatile due to Federal Reserve policies and global uncertainties. The S&P 500 and Dow Jones have seen fluctuations, influenced by interest rate adjustments. However, experts at Goldman Sachs predict economic fundamentals remain strong, making a severe downturn unlikely.

Consumer Sentiment Breakdown:

| Concern | Public Perception | Economic Impact |

| Inflation | 47% fear rising costs | Impacts household spending |

| Stock Market | Volatile but steady | Affects investor confidence |

| Job Security | Employment remains strong | Encourages economic growth |

A University of Michigan survey revealed that 47% of Americans believe a recession is imminent, mainly due to rising living costs. Household savings have also dipped, from 7.1% in Q4 2024 to 6.2% in Q1 2025, showing that Americans are spending more cautiously.

White House Strategies to Maintain Economic Growth

The administration has implemented key initiatives to support economic stability:

- Tax Relief Measures – Expanding middle-class tax cuts to ease financial burdens.

- Infrastructure Investments – Allocating $1 trillion for transportation, broadband, and clean energy projects to create jobs.

- Affordable Housing Programs – A $250 billion initiative to increase home availability and control rent inflation.

These measures aim to sustain growth, create employment, and provide financial relief for American families.

Expert Opinions on the Recession Debate

Economists from the Brookings Institution and the Federal Reserve Bank of New York agree that while recession fears exist, economic fundamentals do not indicate an immediate downturn. However, they advise monitoring consumer debt levels, interest rates, and global trade trends.

Read a detailed analysis on economic stability from the Federal Reserve.

Conclusion: What Lies Ahead for the U.S. Economy?

The White House remains confident in economic resilience, backed by job growth and government initiatives. However, public concern and market trends reflect cautious optimism. The next few months will determine whether current policies effectively maintain stability.

Key Takeaways:

- The U.S. job market remains strong, reducing immediate recession risks.

- Consumer sentiment is mixed, with inflation concerns persisting.

- White House policies aim to sustain growth and economic confidence.