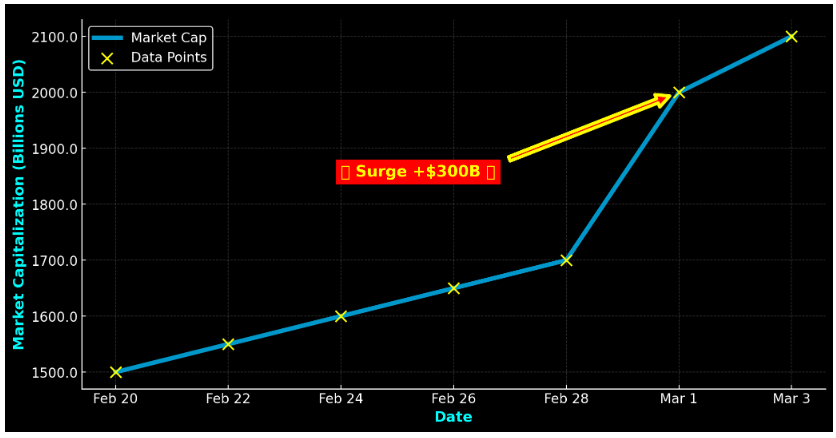

Trump’s Crypto Endorsement Sparks $300 Billion Market Surge

Trump’s Crypto Endorsement has become the catalyst for one of the most significant market surges in cryptocurrency history, with the total market capitalization skyrocketing by $300 billion in just 48 hours. This unprecedented growth has not only captured the attention of investors worldwide but also reignited discussions about the future of digital assets in the United States. In this article, we’ll dive deep into the details of this historic event, explore its implications, and provide actionable insights for anyone looking to understand or capitalize on this market movement.

The Impact of Trump’s Endorsement on the Crypto Market

Donald Trump’s recent endorsement of cryptocurrencies has sent shockwaves through the financial world. During a rally, he praised digital assets like Bitcoin and Ethereum, calling them “the future of finance.” This statement has had an immediate and profound impact on the market.

Key Components:

- Market Reaction: Within hours of Trump’s speech, Bitcoin surged past 70,000, and Ethereum broke the 70,000, and Ethereum broke the 3,500 marks. Altcoins like Solana and Cardano also saw double-digit percentage gains.

- Investor Confidence: Trump’s endorsement has boosted investor confidence, particularly among institutional investors who have been cautiously the crypto space.

- Political Influence: This event highlights the growing influence of political figures on financial markets, a trend that is likely to intensify as the 2024 U.S. presidential election approaches.

Market Reaction Post-Endorsement

| Cryptocurrency | Price Before Endorsement | Price After Endorsement | Percentage Increase |

|---|---|---|---|

| Bitcoin | $65,000 | $70,000 | 7.7% |

| Ethereum | $3,200 | $3,500 | 9.4% |

| Solana | $140 | $160 | 14.3% |

| Cardano | $0.45 | $0.52 | 15.6% |

Why This Surge Matters

The $300 billion market surge is not just a short-term spike; it represents a broader shift in how cryptocurrencies are perceived. This section explains why this development is significant and what it means for the future of digital assets.

Key Components:

- Mainstream Adoption: Trump’s endorsement has brought cryptocurrencies into the mainstream conversation, attracting new investors and increasing public awareness.

- Regulatory Clarity: His call for clearer regulations could pave the way for more robust frameworks, reducing uncertainty and fostering long-term growth.

- Global Competition: By positioning the U.S. as a leader in the crypto space, Trump’s stance could help the country compete with other crypto-friendly nations like El Salvador and Singapore.

Key Components:

- Michael Saylor, MicroStrategy CEO: “Trump’s endorsement is a watershed moment for Bitcoin. It signals that cryptocurrencies are no longer a niche asset but a cornerstone of the global financial system.”

- Coinbase Report: “The surge in market capitalization reflects growing institutional interest, with hedge funds and corporations increasingly allocating funds to digital assets.”

- Federal Reserve Data: The Fed’s recent statements suggest a cautious but open approach to cryptocurrencies, indicating potential regulatory developments in the near future.

Expert Opinions

| Expert | Role | Key Insight |

|---|---|---|

| Michael Saylor | MicroStrategy CEO | “Trump’s endorsement is a watershed moment for Bitcoin.” |

| Coinbase Report | Leading Crypto Exchange | “Growing institutional interest is driving the market surge.” |

| Federal Reserve | U.S. Central Bank | “Cautious but open approach to cryptocurrencies, indicating future regulations.” |

Conclusion: What’s Next for the Crypto Market?

Trump’s crypto endorsement has undeniably reshaped the landscape of digital assets, sparking a $300 billion market surge and bringing cryptocurrencies into the political spotlight. As the 2024 election approaches, the intersection of politics and finance will likely play a pivotal role in shaping the future of the crypto market.

Key Components:

- Future Trends: Increased institutional investments, clearer regulations, and greater mainstream adoption.

- Strategic Decisions: For investors, this is a critical moment to stay informed and make strategic decisions.

- Long-Term Impact: Understanding the implications of this development is key to navigating the rapidly evolving world of cryptocurrencies.

Future Trends in Crypto Market

| Trend | Description |

|---|---|

| Institutional Investments | Increased allocation of funds by hedge funds and corporations. |

| Regulatory Clarity | Development of clearer frameworks for crypto regulations. |

| Mainstream Adoption | Greater public awareness and participation in the crypto market. |