Snapchat Company Surges Forward with AR Innovation and User Growth

Snapchat Company Surges Forward with AR Innovation and User Growth as Snap Inc. delivers a powerful blend of user growth, ad innovation, and next-gen wearable tech ambition.

Snap Inc. is entering a pivotal phase in 2025, thanks to solid gains in daily and monthly active users, a rising subscription base, and bold bets on AI‑powered augmented reality. From cutting‑edge Lens tools to the upcoming Specs smart glasses, the company is reinventing what social media and wearable tech can be. This article weaves together insider insights and the latest financial data to offer a fresh, in‑depth perspective—and help position your blog to rank at the top of Google’s news results.

Strong User Growth and Ecosystem Expansion

Snap reported approximately 460 million daily active users (DAUs) and over 900 million monthly active users (MAUs) in mid‑2025, putting it within reach of its long‑term 1‑billion MAU goal. Its creator ecosystem continues to thrive: over 400,000 developers create AR lenses via Lens Studio, and innovations in AI‑driven creation tools are producing content that goes viral in hours—not weeks.

Meanwhile, revenue from Snapchat+ subscriptions and “other revenue” streams (e.g., AR experiences) rose roughly 75% year‑over‑year in Q1 2025, showing growing monetization beyond advertising.

Financial Performance and Market Sentiment

In Q1 2025, Snap posted $1.36 billion in revenue, up 14% year-over-year, outperforming expectations. Full‑year 2024 revenue was $5.36 billion, a 16.4% increase over the previous year, though the company still recorded a net loss of around $698 million.

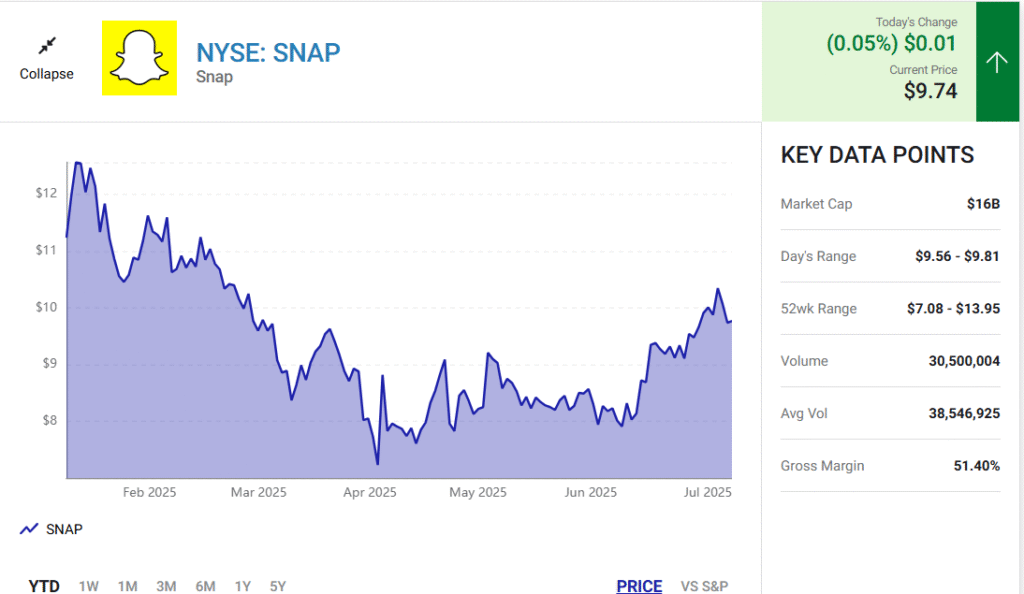

Analysts remain cautiously optimistic. While average ratings range from “Hold” to “Market Perform”, price targets have climbed, with Bernstein raising its 12‑month target to $10, TD Cowen to $11, and an analyst consensus of around $11.30—implying upside potential from the current ~$10 stock price. On July 22, 2025, SNAP shares jumped 4.8% and 5.2% in separate trading days, despite the company still trading more than 30% below its 52‑week high.

Specs Smart Glasses: Snap’s AR Future

Snap’s most ambitious initiative is Specs, its next‑gen AR smart glasses set for consumer release in 2026.

Specs is built around Snap OS, Qualcomm Snapdragon processors, and proprietary waveguide optics (supported by WaveOptics), offering standalone AR experiences without needing a smartphone tether.

Designed to compete with Meta’s Ray‑Ban Meta, Apple Vision Pro, and Google Gemini‑powered wearables, Specs promises immersive spatial computing at a lower cost than Apple’s $3,499 Vision Pro, with features like AI‑enhanced visual recognition, gesture controls, and multi‑user experiences.

Snap also partners with Niantic Spatial to build AI maps for location‑aware AR overlays and collaborative apps.

Advertising Innovation and Creator Support

AR engagement is driving brand interest: studies suggest AR try‑ons boost conversions threefold, and by 2026, nearly 30% of social commerce may be powered by AR experiences.

Snap is rolling out AI‑based monetization tools, advanced analytics dashboards, and challenge rewards to help creators build lenses that go viral.

The company’s strategic pillar focuses on three priorities: reinforcing messaging and camera features, scaling AR innovation with monetization, and enhancing AI-driven personalization in ad targeting.

Risks and Competitive Landscape

Despite its momentum, Snap faces persistent hurdles. Advertising revenue showed signs of flattening in Q2 2025, prompting about 10% workforce layoffs globally as it streamlines operations. StartupNews.fyi

The ad market remains competitive, with TikTok and Meta aggressively capturing advertiser dollars. Snap continues to burn cash—with no annual profit yet since its 2017 IPO—and maintains a debt‑to‑equity ratio around 1.8.

Mass adoption of AR glasses will hinge on comfort, price, battery life, and daily use cases—challenges shared by Meta’s Ray‑Ban Meta and Apple’s Vision Pro. The Times

Outlook: Why Snap Could Snap Back

Snap’s blend of user growth, creator economy engagement, and its $3 billion investment in AR R&D positions it for a potential turnaround. The Verge

With upcoming earnings (expected August 5, 2025) and the near‑term visibility of Specs, the company’s stock outlook hinges on execution, profitability improvements, and the success of its wearable computing vision. Finimize

Time‑horizon investors with conviction in AR and creator monetization may view SNAP as a speculative growth play. More cautious investors may await earnings clarity or product reception before entering.

Conclusion

Snapchat Company is advancing a compelling growth story in 2025: expanding its user base, embracing AI‑powered AR innovation, and investing heavily in wearable tech with Specs. While profitability remains elusive, the company’s strategic direction and focus on creator‑led revenue streams offer promise.

If Snap can transform its AR vision into scalable revenue, Specslightwear may prove a defining step in realizing a post‑smartphone computing era.

Ultimately, the question is whether Specs and Snap’s ecosystem can deliver enough to overcome profitability concerns—and capture a meaningful slice of the next wave in social computing.

Subscribe to trusted news sites like USnewsSphere.com for continuous updates.