The U.S. economy contracts 0.3% in Q1 – what it means for your money in 2025 could be far more significant than many expected. This unexpected downturn, driven by a surge in imports to dodge new tariffs, slowing consumer spending, and cuts in federal expenditure, has put pressure on both businesses and American households. Here’s a breakdown of the major economic shifts in early 2025 and how they directly impact your wallet.

What Caused the 0.3% Economic Contraction in Q1 2025?

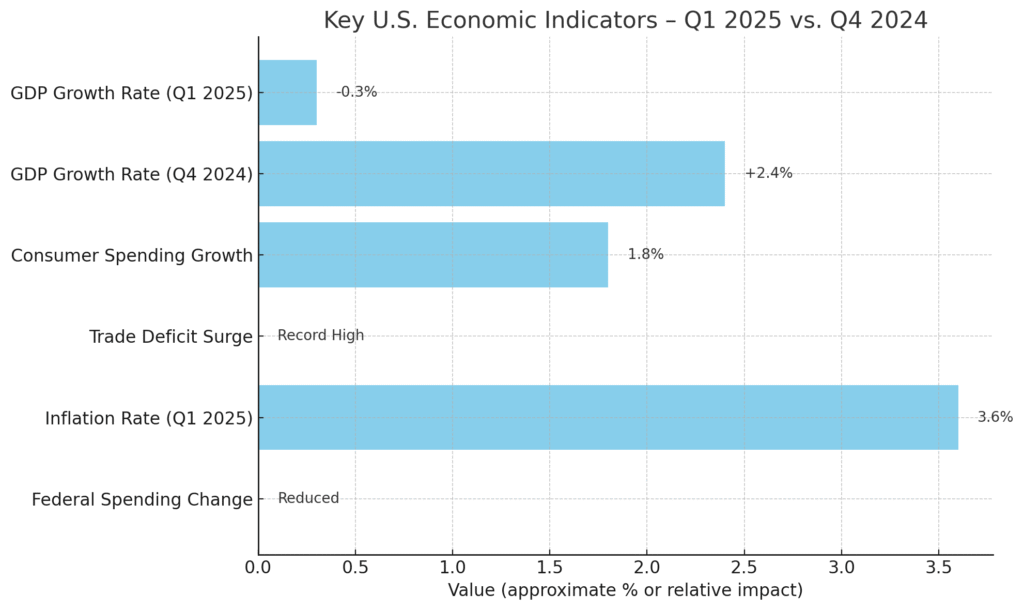

After steady growth in 2024, Q1 2025 has introduced new economic stressors. According to the Commerce Department, the U.S. Gross Domestic Product (GDP) fell by an annualized rate of 0.3%, a sharp contrast to the 2.4% growth recorded in the previous quarter.

Key reasons behind the contraction include:

- A record-high trade deficit as companies rushed to import goods before tariffs kicked in.

- A drop in consumer spending, with growth slowing to just 1.8%.

- Federal budget tightening, which reduced government spending and investments.

Snapshot of the U.S. Economy in Q1 2025

Below is a simplified table to help readers clearly understand how different economic indicators changed between late 2024 and early 2025.

How Tariffs Drove the Trade Deficit and Slowed the Economy

Tariffs were a major player in this economic decline. In an attempt to avoid higher costs from new tariffs, many U.S. businesses front-loaded imports in late 2024 and early 2025. This short-term solution led to an unsustainable trade imbalance.

By pulling forward purchases, companies inflated import levels in Q1, worsening the trade deficit and contributing to the GDP decline. The trade imbalance also meant that domestic manufacturing took a hit, affecting jobs and supply chains across the country.

Impact on American Consumers and Households

The contraction is not just a headline—it’s already affecting everyday Americans. Slower economic growth means fewer job opportunities, more expensive goods, and less financial security.

Top Impacts on U.S. Households:

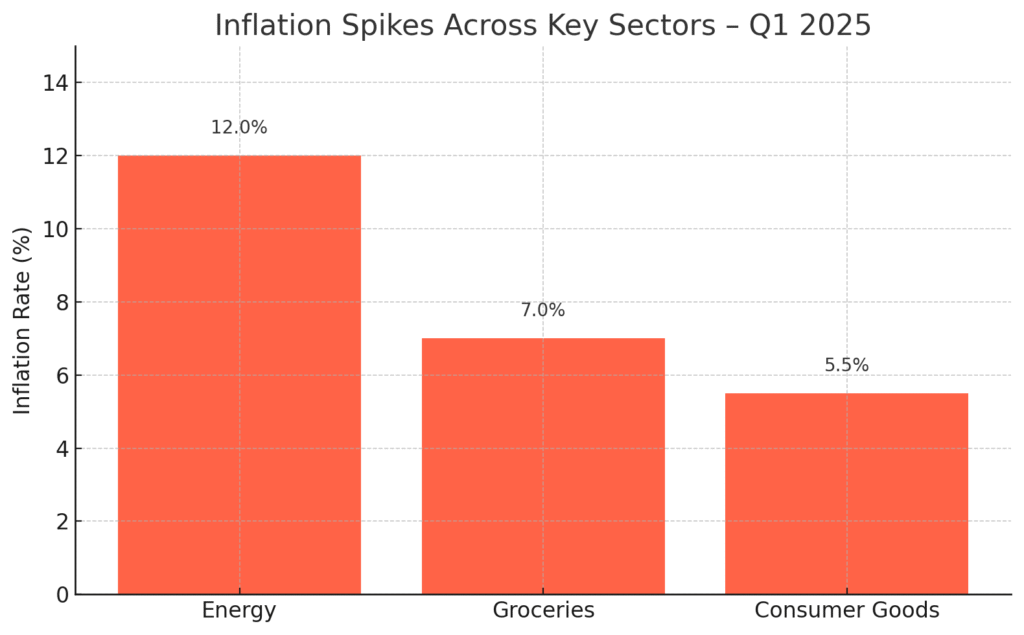

- Inflation pressures continue, with prices rising 3.6% in Q1.

- Credit markets tightening as financial institutions anticipate more risk.

- Stock market fluctuations affecting 401(k)s and investment portfolios.

- Rising costs of imported goods and fuel driven by new tariffs.

Is This the Start of a Larger Recession?

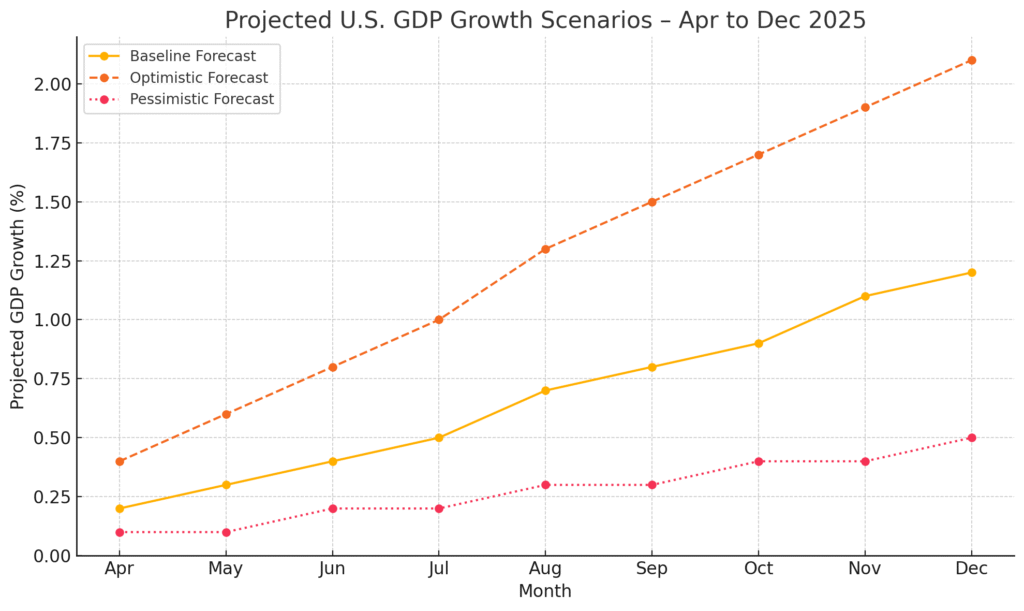

This contraction has raised fears about whether the U.S. is entering a broader recession. While a single quarter of negative growth doesn’t define a recession, the combination of contracting GDP, reduced spending, and rising costs is concerning.

Economists warn that if inflation remains high and the Federal Reserve maintains its cautious stance, the risk of recession increases in the latter half of 2025.

Federal Reserve’s Current Strategy

In response to the Q1 numbers, the Federal Reserve chose to keep interest rates steady. Their main concern: avoiding a full-blown recession while still keeping inflation under control.

If economic conditions continue to weaken, the Fed may consider rate cuts later in 2025—but only if inflation slows down significantly.

What This Means for Your Money

If you’re an investor, homeowner, or even a paycheck-to-paycheck worker, this contraction affects you. Here’s how:

| Category | Impact in Q1 2025 |

|---|---|

| Retirement accounts | Volatility in markets cut 401(k) values by 5-8% |

| Mortgages | Fixed-rate loans hold, but variable rates climb |

| Groceries | Prices up 7% year-over-year |

| Gasoline | Fuel costs up 12% from January 2025 |

| Credit cards | Interest rates remain high, nearing 24% APR |

Can Tariffs Be Reversed or Reduced?

As of now, the administration maintains a firm stance on the tariffs. Analysts suggest that unless trade negotiations with key partners such as China and the EU evolve positively, the tariffs are likely to stay for the rest of 2025.

Expert Insights and External Source

A detailed analysis from MarketWatch confirms that much of the contraction stems from a tariff-driven import surge and weakening consumer activity. Their data supports the risks of continued slowdowns if current trade policies remain unchanged.

Conclusion: What to Watch Next

The 0.3% contraction in Q1 2025 is a wake-up call for American policymakers and the public. With inflation still present and government spending tightening, the next two quarters will be crucial. Watch for changes in tariff policy, Federal Reserve decisions, and consumer spending behaviors.

Understanding this data today helps you make smarter financial moves tomorrow—whether it’s adjusting your investments, rethinking major purchases, or planning for a more volatile economy.

[USnewsSphere.com / mw.]