In recent weeks, Wall Street has been abuzz with a new term: the “TACO trade,” an acronym for “Trump Always Chickens Out.” This phrase encapsulates a pattern where President Donald Trump announces aggressive tariffs, causing market turbulence, only to retract or delay them, leading to market rebounds. As this strategy gains attention, questions arise about its effectiveness and impact on the global economy.

The Genesis of the TACO Trade

The term “TACO trade” was coined by Financial Times columnist Robert Armstrong in early May 2025. He observed that markets would dip following Trump’s tariff threats but would recover once those threats were rescinded or postponed. This pattern became evident when Trump announced a 50% tariff on European Union goods, only to delay its implementation after market backlash and discussions with EU leaders.

Similarly, a proposed 145% tariff on Chinese imports was frozen for 90 days, leading to a 2.1% rally in the S&P 500. These instances highlight a recurring cycle: bold tariff announcements followed by strategic retreats, prompting investors to capitalize on market fluctuations.

Trump’s Defense: Negotiation or Capitulation?

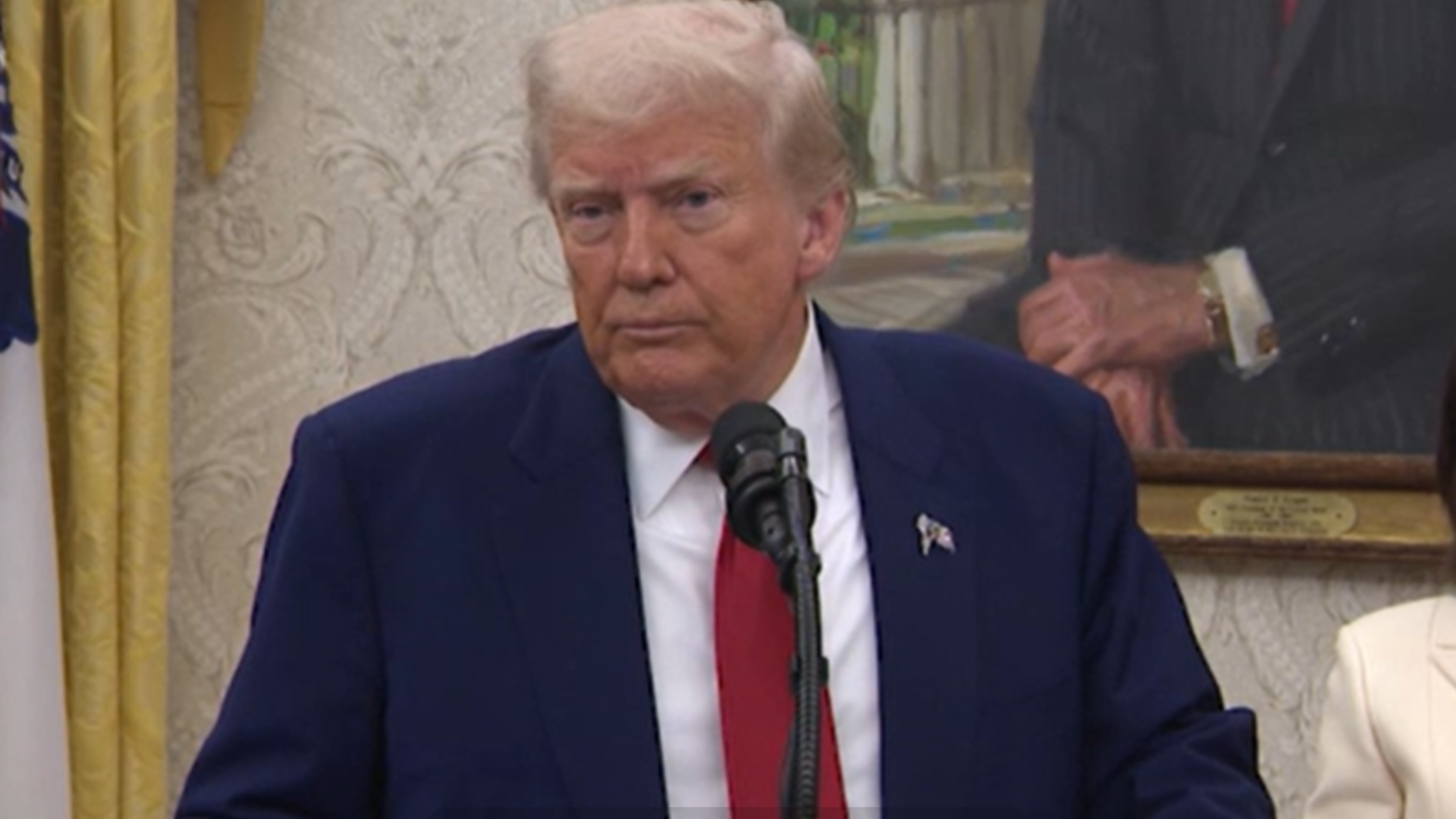

When confronted about the “TACO trade,” President Trump dismissed the term as a “nasty question,” asserting that his tariff strategies are part of a broader negotiation tactic. He emphasized that initial high tariffs are meant to bring trade partners to the table, after which concessions can be made.

Trump’s approach has seen mixed results. While some negotiations, like those with the UK and China, have led to reduced tariffs and provisional deals, critics argue that the constant flip-flopping undermines U.S. credibility. Economist Justin Wolfers noted that such threats have lost their potency, as markets and international actors increasingly view them as bluffs.

Market Implications and Investor Strategies

The TACO trade has become a notable strategy among investors. Recognizing the pattern of tariff threats followed by retractions, traders have started to “buy the dip,” purchasing stocks during market downturns caused by tariff announcements and selling during subsequent recoveries.

However, analysts caution that this strategy may not be sustainable. As awareness of the TACO trade grows, its effectiveness could diminish. Moreover, the underlying volatility introduced by unpredictable tariff policies poses risks to long-term economic stability. Tom Essaye, founder of Sevens Report Research, warns that while short-term gains are possible, the broader economic implications of erratic trade policies could be detrimental.

International Repercussions and Diplomatic Strains

Trump’s tariff strategies have not only impacted markets but also strained international relations. Countries like Canada and Mexico have responded to U.S. tariffs with retaliatory measures, leading to escalating trade tensions. For instance, after the U.S. imposed a 25% tariff on Canadian imports, Canada announced its own set of tariffs on U.S. goods, further complicating trade dynamics.

Similarly, Mexico faced 25% tariffs on its exports, prompting discussions about potential retaliatory tariffs and highlighting the fragility of trade agreements under the current U.S. administration.

The Future of the TACO Trade and Global Markets

As the TACO trade gains prominence, its long-term viability remains uncertain. While some investors have profited from the predictable pattern of tariff announcements and retractions, the broader economic consequences of such policies are concerning. Continued volatility can erode investor confidence, disrupt global supply chains, and hinder economic growth.

Moreover, the international community’s response to these tactics will play a crucial role in shaping future trade dynamics. If countries perceive U.S. trade policies as unreliable, they may seek alternative partnerships, potentially diminishing America’s influence in global markets.

In conclusion, the TACO trade underscores the intricate interplay between political strategies and market reactions. While short-term gains are evident, the long-term implications of such tactics warrant careful consideration. As global economies navigate these challenges, staying informed and critically analyzing policy decisions becomes imperative.

Subscribe to trusted news sites like USnewsSphere.com for continuous updates.

[USnewsSphere.com / tt.]