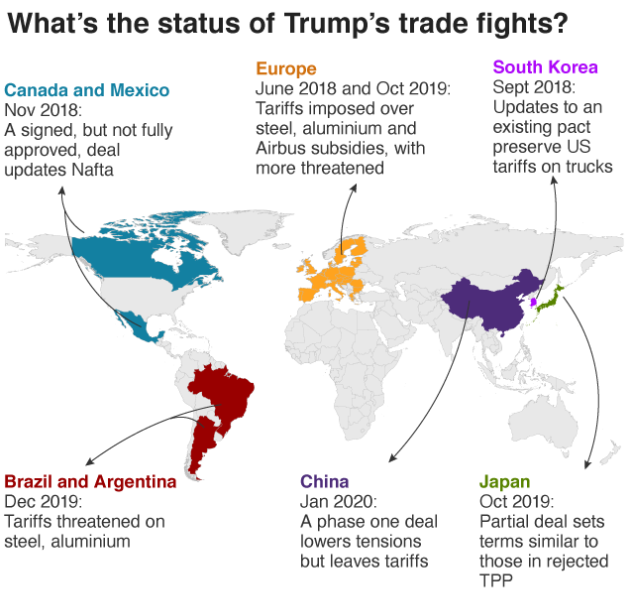

Trump’s tariff policies triggered the ‘Donald-25’ market shock, causing widespread economic disruption in the U.S. This blog breaks down how the policy unfolded, what it means for your finances, and how Americans can prepare for the turbulent weeks ahead.

1. What Is ‘Donald-25’? Why It Matters Now

Donald-25 is the name coined by economists and media to describe the sudden economic crash that followed President Trump’s April 2025 tariff announcement. The administration imposed a 25% tariff on all imports from China, Mexico, and Canada.

What Led to the ‘Donald-25’ Market Shock?

[Donald-25 Crash]

|

-------------------------------------

| | |

[Trump's Tariff] [Global Backlash] [Market Panic]

| | |

25% tariffs Retaliatory tariffs $1.8T lost in stock

on imports from allies market in 72 hours

Key Point: The term isn’t just political. It reflects real economic pain—stock losses, inflation, and policy uncertainty.

2. Timeline of Events: From Tariff to Crash

| Date | Event | Economic Impact |

|---|---|---|

| April 2, 2025 | Trump announces 25% tariffs on China, Mexico, Canada | S&P 500 drops 6.3% in one day |

| April 4, 2025 | China responds with 100% tariff on U.S. tech goods | Dow Jones loses 3,200 points |

| April 6, 2025 | Canada imposes beef and auto tariffs | U.S. export market declines by $450B |

| April 8, 2025 | Retail and manufacturing stocks plummet | Job loss risk rises across 3 major industries |

3. Who’s Being Hit the Hardest by the Tariffs?

The average American consumer is facing:

- Rising grocery bills (+9% since tariffs)

- Electronics up 12%, with iPhones, TVs, and laptops most affected

- Gas prices up 14% as trade flow disruptions hit oil supply

Real Data from U.S. Economic Policy Center:

- $4,300/year average cost increase per household

- 132,000 jobs at risk in logistics, auto, and retail sectors

4. Global Reaction: Allies Strike Back

America’s key trading partners responded swiftly:

- China: Imposed 100% tariffs on U.S. electronics and soybeans

- Canada: Hit U.S. beef, dairy, and auto sectors with counter-tariffs

- Mexico: Suspended agricultural imports worth $20 billion

Result: International confidence in U.S. economic stability has plummeted, affecting foreign investment and exports.

5. What Experts Are Saying: Divided Opinions

Supporters of the tariffs say:

“This is how we reclaim American manufacturing strength.” – Republican House Leader

Critics argue:

“This move risks recession, inflation, and trade isolation.” – Former Treasury Secretary Larry Summers

According to the Wharton Budget Model:

- GDP may shrink by 6% over 18 months

- Wage growth may reverse by -4% annually

6. How Americans Can Prepare for the Financial Fallout

To navigate the instability caused by Trump’s tariff policies:

- Track expenses and cut down on non-essential imports

- Adjust investment portfolios by diversifying out of high-risk sectors (auto, electronics)

- Watch policy updates closely—Congress may push for rollback amendments in coming weeks

7. Will the Economy Recover Soon? What’s Next?

The future depends on:

- Whether Trump softens the tariff terms under pressure

- International trade negotiations scheduled for May 2025

- How fast U.S. businesses can adapt to supply chain changes

Current U.S. Economic Indicators (April 2025)

| Indicator | Value | Trend |

|---|---|---|

| S&P 500 Index | 4,870 pts | ↓ 9.4% |

| Dow Jones | 36,570 pts | ↓ 8.1% |

| Inflation Rate | 6.1% | ↑ from 3.8% |

| Consumer Confidence Index | 68.2 | ↓ from 82.5 |

| Import Costs (Avg.) | +11.2% | ↑ sharp increase |

8. Final Thoughts: The Bigger Picture for American Readers

The “Donald-25” crash isn’t just a market correction—it’s a powerful signal that global interdependence matters. Tariffs aren’t just taxes on foreign countries; they hit home, affecting every American wallet.

While political motivations may drive these decisions, the numbers don’t lie: without immediate trade flexibility, the U.S. economy risks deeper inflation and prolonged recovery.

[USNewsSphere.com / bl.]