Stock Market Volatility Ahead: Experts Warn of Recession Risks as Inflation and Geopolitical Tensions Rise

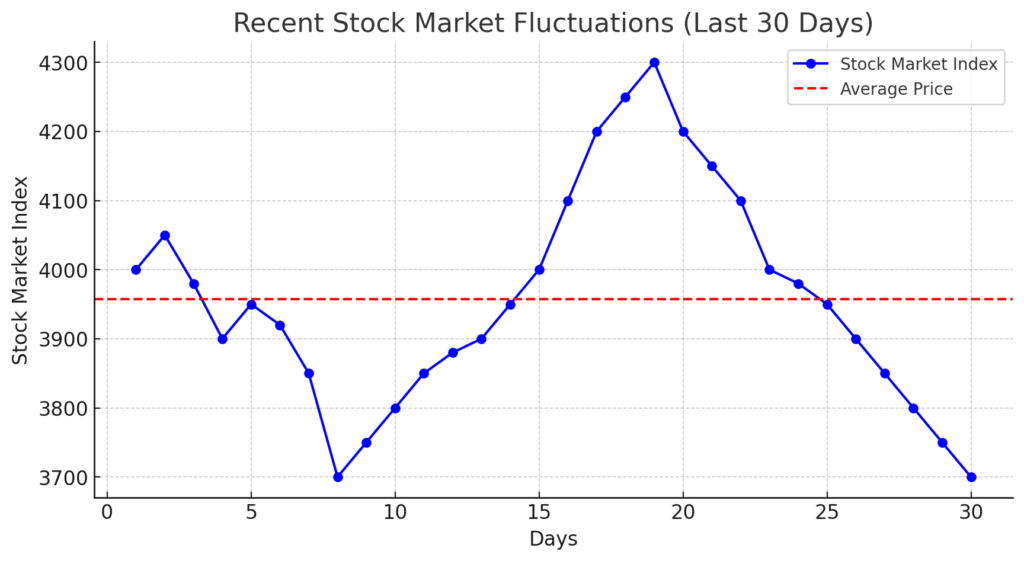

The U.S. stock market is facing significant volatility as experts warn of an impending recession, fueled by rising inflation, interest rates, and geopolitical tensions. Investors are navigating uncertainty as the Federal Reserve signals potential rate adjustments, while global conflicts and tech sector declines add further instability.

This article dives deep into the key drivers of market turbulence, their potential impact on the economy, and how investors can protect their portfolios in these uncertain times.

Table of Contents

Key Factors Driving Market Volatility in 2025

1. Rising Inflation and Interest Rates

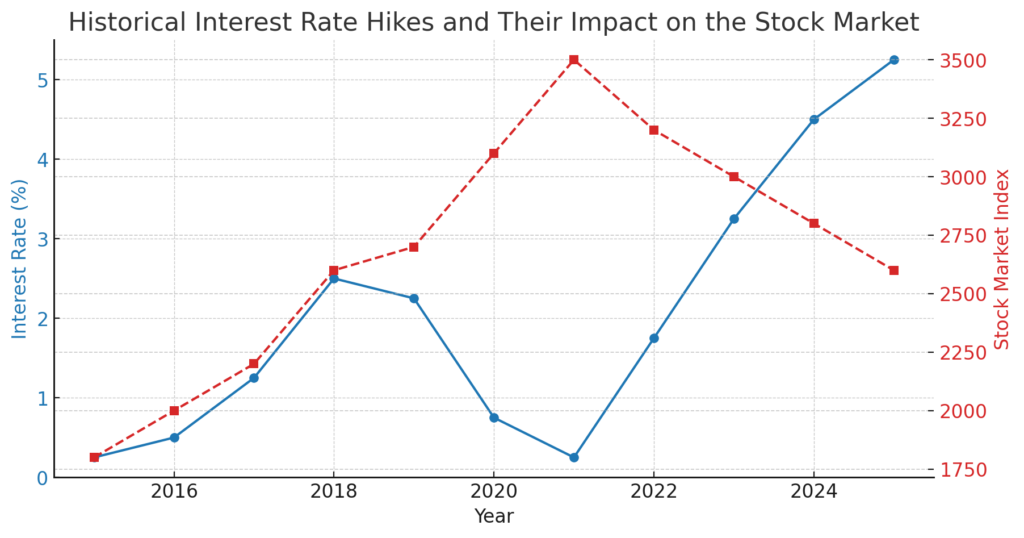

Inflation remains a critical concern, with recent reports showing core inflation rising faster than expected. The Federal Reserve has hinted at possible rate hikes in 2025, which could slow economic growth and impact corporate earnings.

Impact: Higher interest rates make borrowing more expensive, reducing business expansion and consumer spending, which directly affects stock market performance.

2. Geopolitical Uncertainty and Global Tensions

Ongoing conflicts and trade disputes between major economies have heightened uncertainty in the global markets. Sanctions, export restrictions, and supply chain disruptions are creating additional financial stress for companies reliant on international trade.

Impact: Geopolitical instability leads to market sell-offs, affecting investor confidence and causing major indexes like the S&P 500 and Dow Jones to fluctuate.

3. Stock Market Sell-Offs and Tech Sector Declines

Recently, the NASDAQ experienced a major dip, with tech giants like Nvidia, Apple, and Tesla witnessing significant losses. Nvidia’s stock dropped 13%, erasing $465 billion in market value, marking the largest single-day loss in U.S. history.

A major contributor to this was the rise of AI competition from China’s DeepSeek, which challenged U.S. dominance in the AI industry.

Impact: The tech sector has been a key driver of stock market growth, and such downturns can trigger broader market declines. The Guardian.

How Investors Can Protect Themselves from Market Turbulence

With market instability on the rise, investors must adopt strategic approaches to safeguard their portfolios.

1. Diversify Your Investments

Holding stocks across different sectors (healthcare, energy, and consumer goods) can help reduce risk exposure from a single industry downturn.

2. Focus on Defensive Stocks

Sectors like utilities, healthcare, and consumer staples tend to perform well during recessions. Investing in dividend-paying stocks can provide consistent income.

3. Monitor Federal Reserve Announcements

Staying informed about interest rate decisions and economic policies will help investors adjust their strategies in time.

4. Hedge with Gold and Bonds

During economic uncertainty, gold and U.S. Treasury bonds often become safe-haven assets, providing stability when stocks decline.

Final Thoughts

The current stock market volatility is a direct result of rising inflation, interest rate uncertainty, geopolitical risks, and the tech industry’s downturn. While market corrections are inevitable, proactive investment strategies can help investors navigate financial turbulence with confidence.

Stay informed, diversify your investments, and be prepared for shifting economic conditions. [USnewsSphere.com]