Stock Market Rollercoaster: Why Wall Street Is Bracing for a Volatile 2024 and What Investors Need to Know

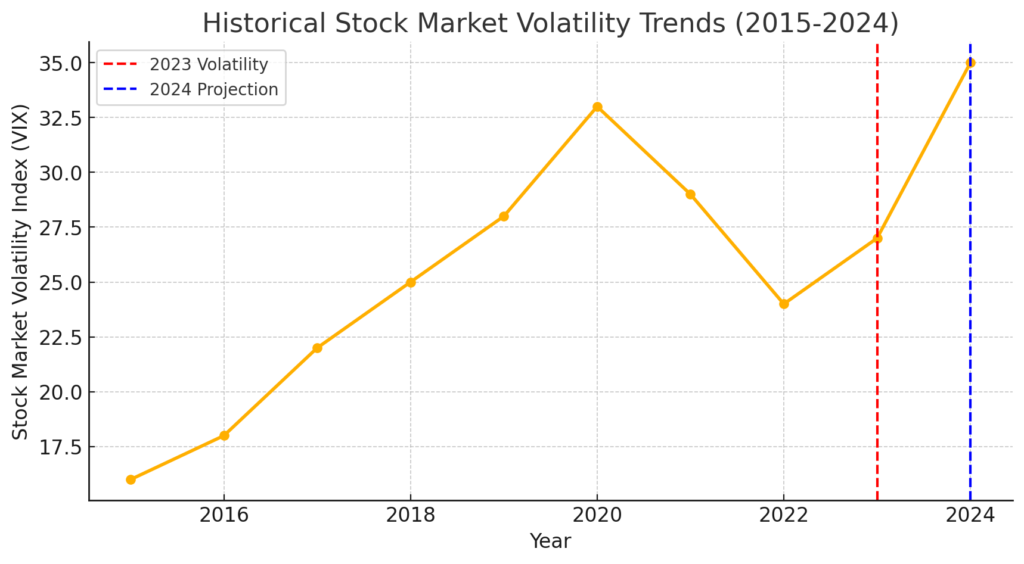

The stock market rollercoaster is gearing up for another wild ride in 2024, and Wall Street is already preparing for heightened volatility. With a mix of economic uncertainty, geopolitical tensions, and shifting Federal Reserve policies, investors are facing a challenging landscape. But what does this mean for your portfolio? In this article, we’ll break down the key factors driving market volatility in 2024, provide actionable strategies to protect your investments, and share expert insights to help you stay ahead. Whether you’re a seasoned investor or just starting out, this guide will equip you with the knowledge to navigate the twists and turns of the stock market in the coming year.

Table of Contents

Why 2024 Could Be a Volatile Year for the Stock Market

- Inflation and Interest Rate Uncertainty

The Federal Reserve’s battle with inflation remains a central theme for 2024. While inflation has eased from its peak, the possibility of additional rate hikes or prolonged high-interest rates continues to create uncertainty. According to a recent report by CNBC, the Fed’s decisions will heavily influence market performance, particularly in growth sectors like technology and real estate. - Geopolitical Risks

Geopolitical tensions, including conflicts in the Middle East and the ongoing war in Ukraine, are adding layers of unpredictability to global markets. These events can disrupt supply chains, drive up commodity prices, and create ripple effects across industries, further fueling market instability. - Election Year Dynamics

2024 is a U.S. presidential election year, and history shows that election cycles often bring market volatility. Policy changes, regulatory shifts, and campaign rhetoric can sway investor confidence, making it essential to monitor political developments closely. - Corporate Earnings and Valuations

Corporate earnings are under pressure from higher borrowing costs and slowing consumer spending. Companies may struggle to meet expectations, leading to downward revisions in stock valuations, particularly for overvalued sectors like tech and consumer discretionary.

What Investors Need to Know to Navigate the Volatility

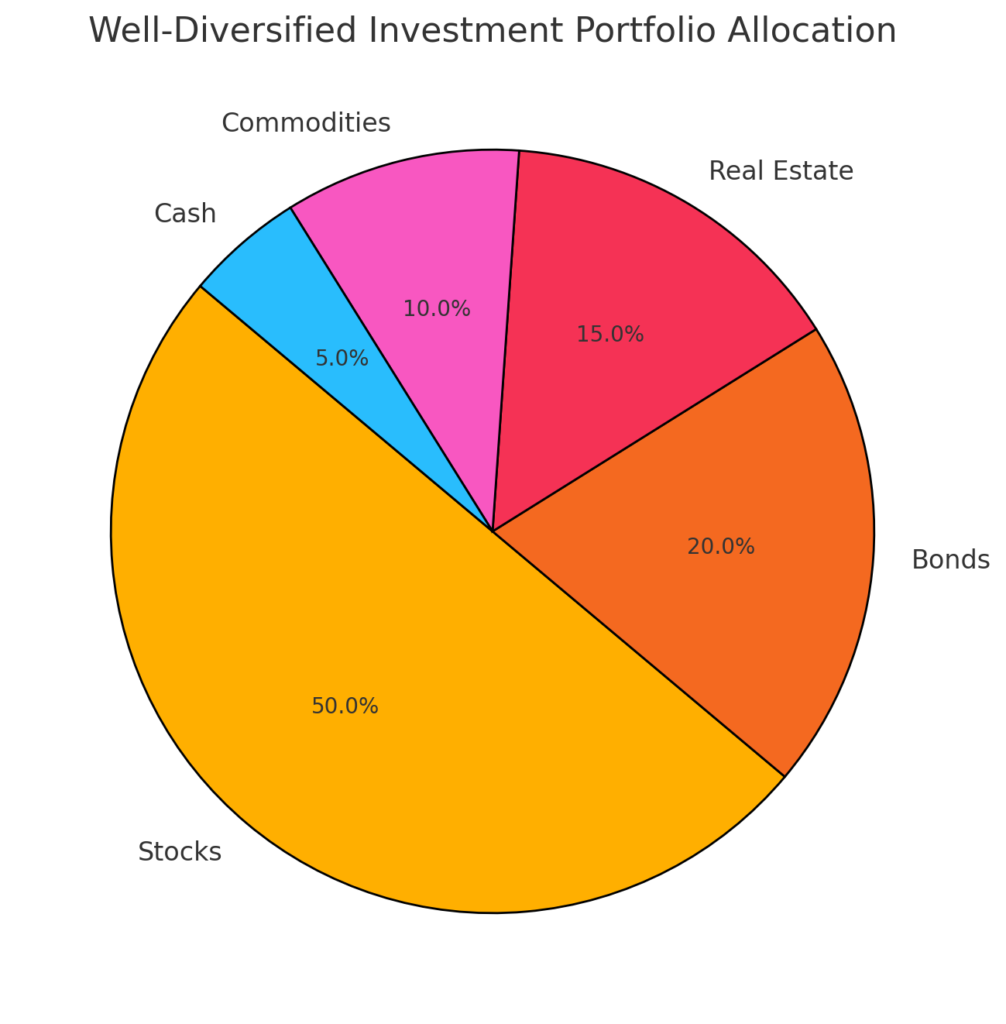

- Diversify Your Portfolio

Diversification is your best defense against market volatility. Spread your investments across asset classes, sectors, and geographies to reduce risk. Consider adding bonds, gold, or other defensive assets to your portfolio. - Focus on Quality Stocks

In uncertain times, prioritize companies with strong balance sheets, consistent cash flows, and competitive advantages. These businesses are better positioned to weather economic downturns. - Stay Informed but Avoid Overreacting

While staying updated on market trends is important, avoid making impulsive decisions based on short-term fluctuations. A long-term perspective can help you ride out volatility. - Consider Defensive Investments

Defensive sectors like healthcare, utilities, and consumer staples tend to perform better during economic uncertainty. Allocating a portion of your portfolio to these areas can provide stability. [USnewsSphere.com]

Conclusion

The stock market rollercoaster of 2024 is shaping up to be a challenging ride for investors. By understanding the key drivers of volatility and adopting a proactive approach to portfolio management, you can navigate the turbulence and seize opportunities in an unpredictable market. Stay informed, stay diversified, and remember that volatility often presents the best chances for long-term growth.