Trump’s Plan to Impose 25% Tariffs on Steel and Aluminum Sparks Global Trade Debate

President Donald Trump’s plan to impose a 25% tariff on steel and aluminum imports has ignited a heated global trade debate. The administration justifies this move on national security grounds, citing Section 232 of the Trade Expansion Act of 1962, which allows the president to adjust imports considered a threat to national security.

The Rationale Behind the Tariffs

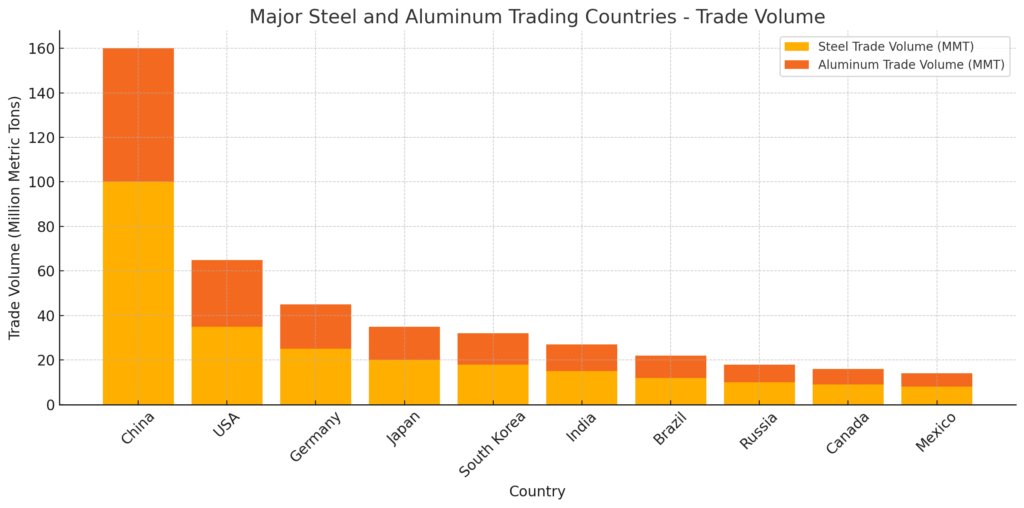

Trump argues that the U.S. steel and aluminum industries have been unfairly affected by cheap imports, particularly from China. By imposing these tariffs, the administration aims to revive domestic production, protect American jobs, and reduce dependency on foreign materials. This strategy mirrors actions from Trump’s first term, where similar tariffs were implemented but later adjusted for key trading partners like Canada and Mexico.

Global Reactions and Potential Retaliations

Internationally, the move has sparked concern. The European Union and other major U.S. trading partners have warned of possible retaliatory measures, potentially leading to escalating trade tensions. In the past, the EU responded to U.S. tariffs with countermeasures on American goods, affecting industries from agriculture to manufacturing.

According to Reuters, economic experts predict that such tariffs could increase costs for American manufacturers reliant on imported metals, potentially leading to higher consumer prices.

Economic Impact on the U.S. Market

While the tariffs aim to bolster U.S. industries, they may have unintended consequences. Higher raw material costs could affect construction, automotive, and beverage industries, all heavily dependent on steel and aluminum. Critics argue this could lead to job losses in sectors reliant on affordable materials.

However, proponents believe that a stronger domestic metal industry could offset these costs in the long term, creating sustainable jobs and reducing foreign trade deficits.

Conclusion

Trump’s 25% tariffs on steel and aluminum have undoubtedly reignited discussions about America’s role in global trade. As the situation develops, economists and policymakers will closely monitor the impact on domestic industries, consumer prices, and international relations. The true effect of these tariffs will unfold in the coming months, shaping not only U.S. economic policy but also global trade dynamics.