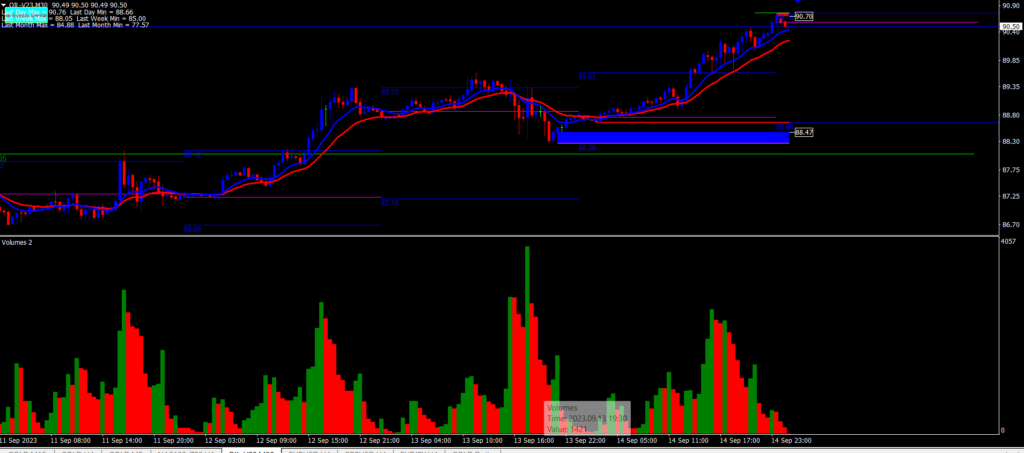

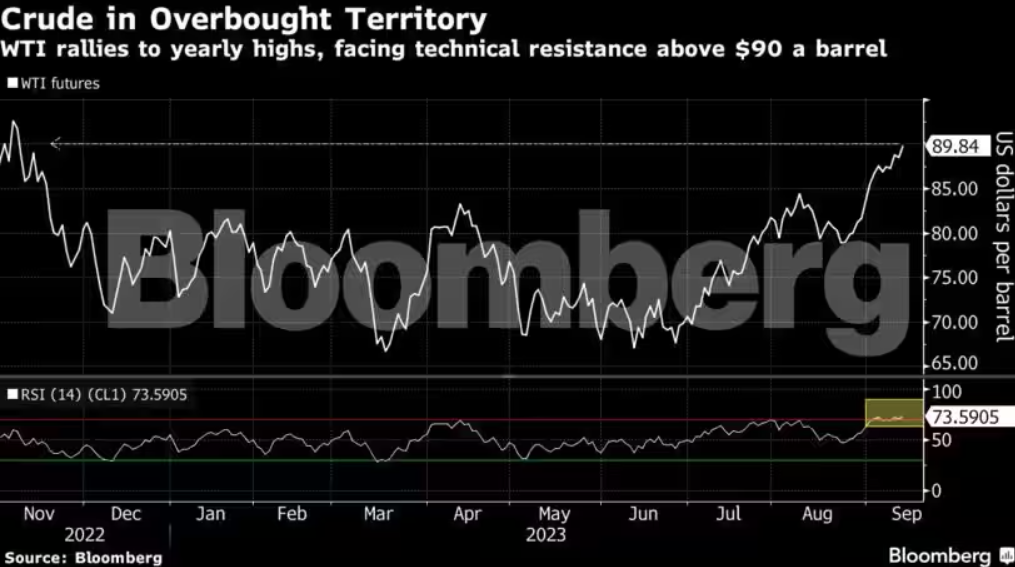

Oil; The global oil market is witnessing a remarkable rally, with the benchmark US crude oil, West Texas Intermediate (WTI), hitting the $90 per barrel mark for the first time since November. This surge in oil prices, up more than 30% since late June, is primarily driven by output cuts from major oil-producing nations, Saudi Arabia and Russia, coupled with record global consumption. However, this price surge has traders on edge as technical indicators signal potential overbought conditions. Additionally, recent warnings from the International Energy Agency (IEA) and OPEC about a significant supply shortfall and growing deficits in the market are adding to the volatility. In this article, we delve deeper into the factors behind the oil price rally and its potential implications.

Key Factors Driving the Oil Price Rally:

- Supply Cuts by OPEC+ Leaders: Saudi Arabia and Russia, as the key players in the OPEC+ alliance, have implemented substantial supply cuts, which have contributed significantly to the surge in oil prices. These cuts are intended to balance supply and demand in the market.

- Record Global Consumption: Despite efforts to transition to cleaner energy sources, global oil consumption remains at a historic high. The demand for oil in the United States and China, the world’s top two consumers, continues to be robust.

- Warning from the International Energy Agency: The IEA has issued a warning regarding the ongoing supply cuts by OPEC+ leaders. It predicts a significant supply shortfall, which is likely to increase price volatility in the coming months.

- OPEC’s Assessment of Market Deficits: OPEC has reported that the market is facing a deficit of over 3 million barrels a day in the next quarter, potentially the largest deficit in more than a decade. This underscores the challenges in meeting global oil demand.

Challenges and Implications:

- Overbought Territory: Traders are becoming cautious as technical indicators, like the relative strength index, suggest that oil futures are nearing overbought territory. This could potentially trigger a pullback in oil prices.

- Economic Impact: While the surge in oil prices benefits oil-producing nations, it raises concerns about whether it will hinder central banks’ efforts to combat inflation. Higher oil prices can lead to increased costs for businesses and consumers.

- Premiums and Demand: Some physical grades of oil are commanding premiums over their benchmarks, indicating strong demand from refiners. Fuels are also trading at higher prices as processors strive to keep up with robust end-user demand.

The recent rally in oil prices, with WTI reaching $90 a barrel, is the result of a complex interplay between supply cuts by major oil-producing nations, record global consumption, and warnings of impending supply shortfalls. While this is a boon for oil-producing economies, it poses challenges for global central banks combating inflation. Traders are closely watching technical indicators for signs of a potential pullback, as the oil market remains highly sensitive to supply and demand dynamics. The next quarter will be pivotal in determining whether this surge continues or moderates.

[cnn.com]