House Republicans Divided Over Funding Strategies for Trump’s Tax Cuts

House Republicans are facing deep divisions over how to fund President Donald Trump’s proposed $6 trillion tax cuts. The proposed extensions to the 2017 Tax Cuts and Jobs Act aim to eliminate taxes on tips, Social Security benefits, and overtime earnings. While the tax cuts promise economic incentives, concerns about the federal deficit and disagreements within the Republican party are hindering progress.

This blog dives into the internal debates, the proposed measures, and their potential impact on U.S. citizens and the economy.

The Core Issue: $6 Trillion Tax Cuts

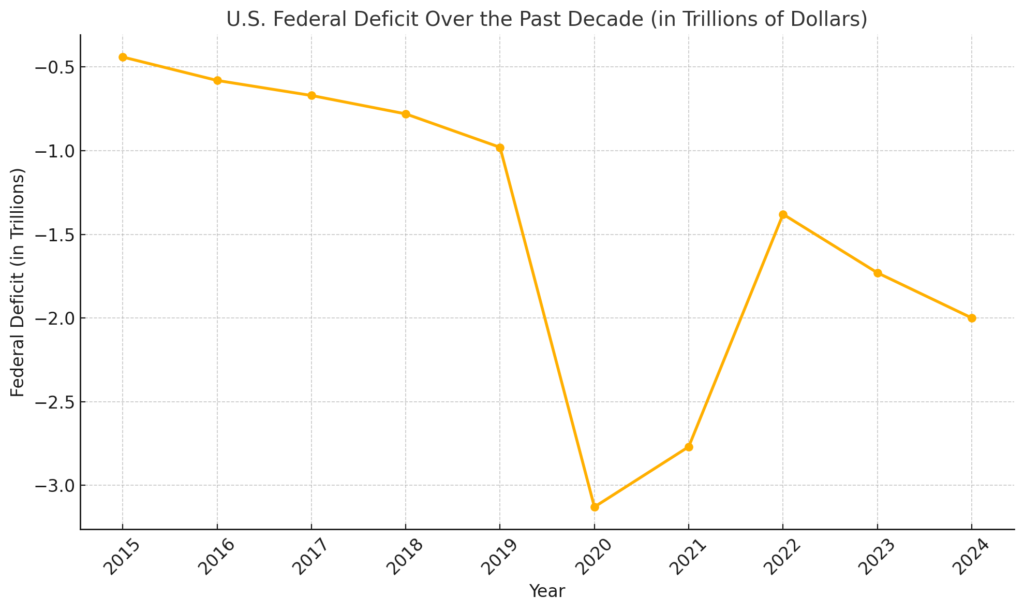

The tax cuts championed by former President Trump have been a cornerstone of his agenda. However, the estimated $6 trillion price tag is a significant concern, particularly as the federal deficit approaches $2 trillion annually.

The Republican party is split into two factions:

- Fiscal Conservatives: This group is focused on balancing the budget and pushing for spending cuts in Medicaid, climate initiatives, and Biden-era health subsidies.

- Moderates: Concerned about the potential backlash from voters, moderates warn against drastic spending cuts, especially those affecting low-income families and essential programs.

Proposed Measures to Offset the Costs

Hardline conservatives have proposed various strategies to fund the tax cuts:

- Medicaid Reductions: Limiting Medicaid funding could save billions but might lead to reduced access to healthcare for millions.

- Repealing Tax Credits: Revoking health cost reduction credits introduced during Biden’s presidency is another contentious proposal.

- Rolling Back Climate Initiatives: Significant cuts to renewable energy programs and environmental protections have also been suggested.

These measures have sparked fierce debates, with some lawmakers arguing they could disproportionately harm vulnerable communities.

The Economic Impact

According to the nonpartisan Committee for a Responsible Federal Budget, extending the 2017 tax cuts would add over $4 trillion to the deficit over the next decade. Additional proposals to eliminate taxes on tips and overtime could add another $1.8 trillion.

Experts warn that such a dramatic increase in the deficit could lead to:

- Higher Borrowing Costs: An elevated deficit may drive up interest rates on government bonds.

- Economic Instability: An imbalance between tax cuts and spending reductions could harm long-term economic growth.

Trump’s Call for Unity

In a recent address at the House Republicans’ annual policy retreat in Doral, Florida, Trump emphasized the need for party unity. He urged lawmakers to back his agenda, which includes tax cuts, immigration measures, and full funding for border security initiatives.

However, achieving unity is proving to be a challenge, with key lawmakers remaining divided on the path forward.

The Path Ahead

For House Republicans, the stakes are high. Balancing fiscal responsibility with the political appeal of tax cuts will require compromise and innovation. As debates continue, it remains to be seen whether the party can unite behind a sustainable strategy.

Conclusion

In conclusion, the debate over President Trump’s $6 trillion tax cuts has revealed significant divisions among House Republicans, highlighting the challenges of balancing fiscal responsibility with political ambitions. The proposed measures, including Medicaid funding reductions and the elimination of certain tax credits, underscore the complexity of managing the federal deficit while advancing economic reforms.

This ongoing conversation raises critical questions about the long-term impact of these policies on the U.S. economy and its citizens. As the federal deficit continues to climb, the stakes for reaching a consensus have never been higher. For readers interested in staying informed on how these decisions will shape America’s economic landscape, understanding the Republican tax cut debates is essential.

We encourage you to reflect on how these tax policy debates may affect your community or business. If this topic resonates with you, share your thoughts in the comments below or explore related articles to dive deeper into the implications of the federal deficit on U.S. economic policies.

Change starts with informed conversations. Stay engaged, stay curious, and be part of the dialogue shaping America’s future. Don’t forget to subscribe for more insights on pivotal topics like the federal deficit and Republican tax cut debates!

Let’s build a future where every voice contributes to meaningful solutions. [USnewsSphere.com]