“Wall Street, often synonymous with financial prowess and corporate giants, is making waves in a new arena: American residential neighborhoods. As this financial titan extends its reach into the heart of our communities, it’s reshaping the landscape of homeownership and challenging our traditional notions of the American Dream. In this blog post, we’ll delve into the implications of Wall Street’s growing influence in the housing market and what it means for everyday families and communities.”

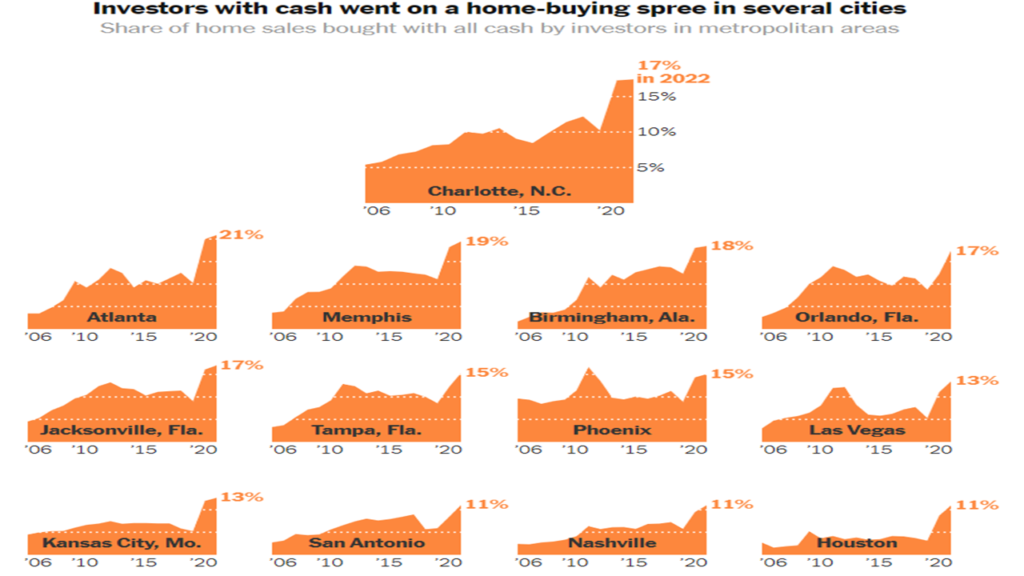

The increasing trend of Wall Street firms and institutional investors buying homes in middle-income neighborhoods, particularly in fast-growing Sun Belt cities like Charlotte, Atlanta, and Phoenix. Here are the key points:

Table of Contents

Wall Street’s Entry:

Wall Street has become a significant player in the housing market, especially in the starter home segment. This has made it challenging for first-time buyers who rely on mortgages, as they often find themselves outbid by cash buyers.

[cnn.com]

Cash Sales:

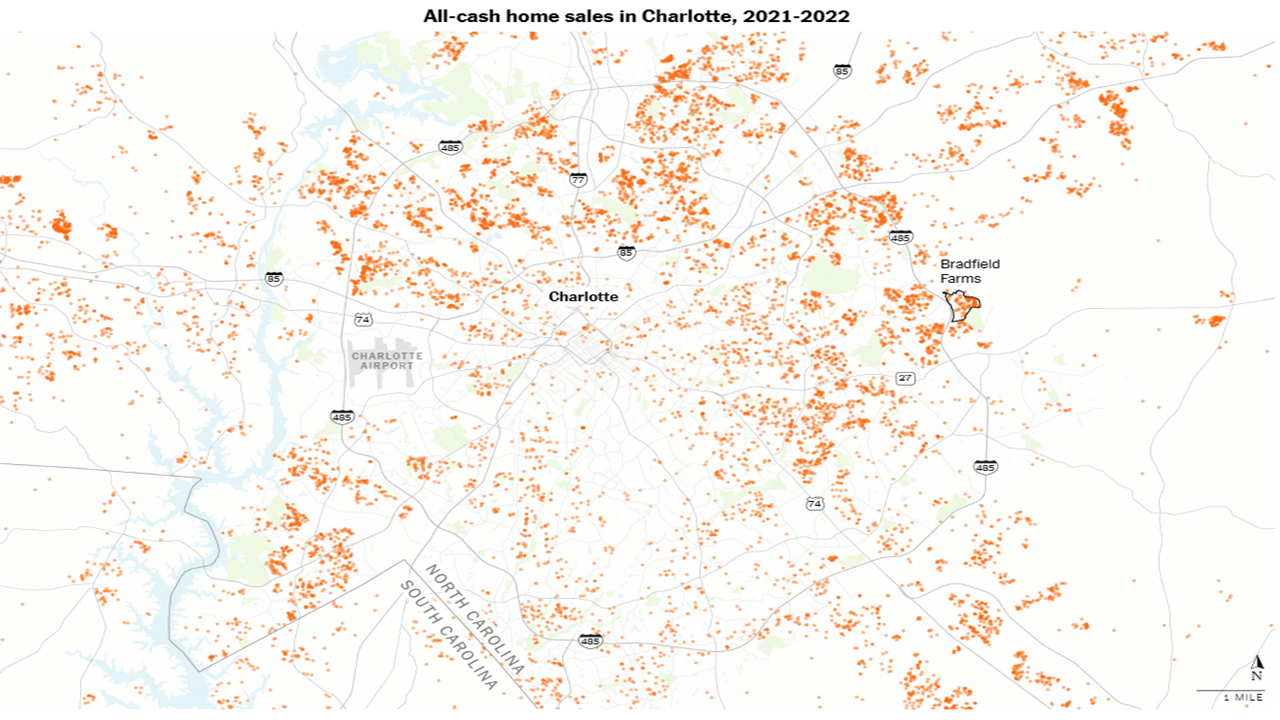

In 2022, over a third of all home sales in the U.S. were made in cash. Investors paying cash accounted for nearly 10% of these purchases.

Targeted Neighborhoods:

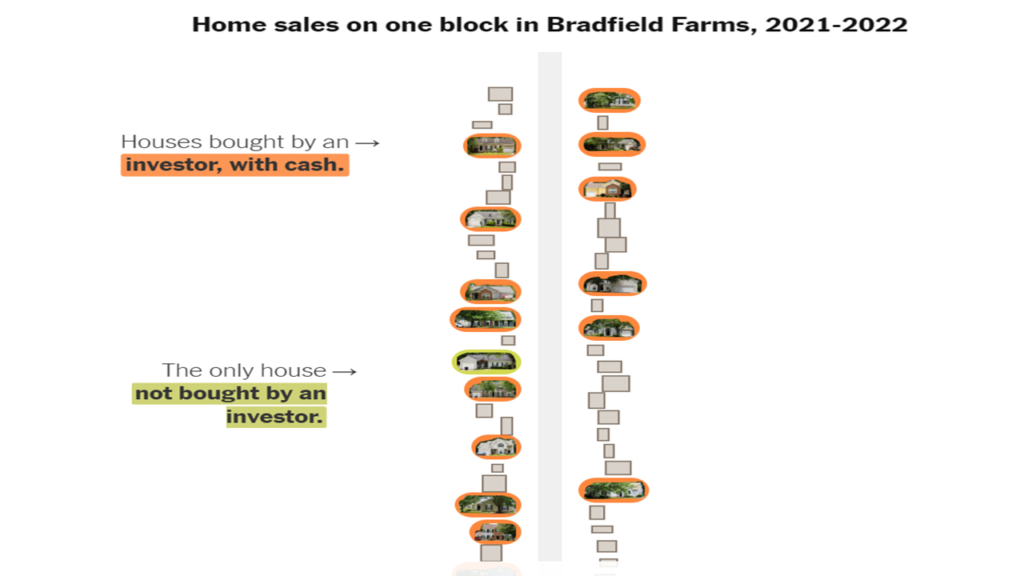

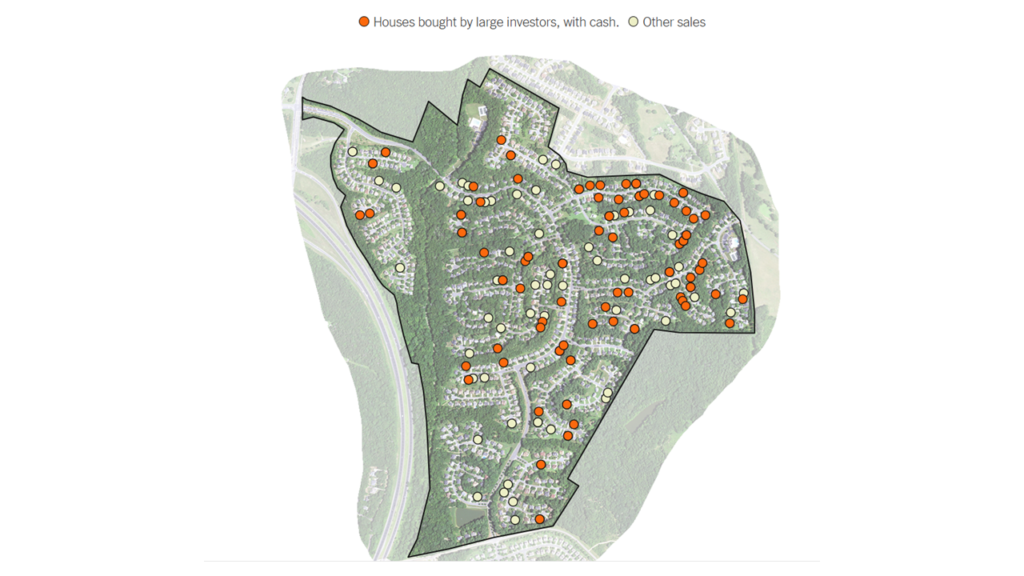

Investors have primarily targeted middle-income neighborhoods, especially those with larger Black and Latino populations. For instance, in Bradfield Farms, an area that was 35% Black and 11% Latino in 2020, investors bought properties at three times the citywide average rate between 2021 and 2022.

Advantages for Sellers:

Homeowners are often tempted to sell to investors because of the quick, hassle-free process. They don’t need to stage the house or wait for appraisals, and the sale is less likely to fall through.

Impact on Renters:

While the single-family rental industry argues that they provide a vital service by offering homes for rent, critics believe that the rise of single-family rentals prevents potential buyers from owning homes. This is particularly concerning for Black and Latino households, which already have homeownership rates below the national average.

Corporate Landlords:

Renters have expressed concerns about corporate landlords. For example, a tenant in Bradfield Farms mentioned that her landlord, Progress Residential, was slow in addressing repair requests.

Community Impact:

The influx of corporate-owned rentals has changed the dynamics of neighborhoods. In some areas, homeowners have tried to cap the number of rentals to maintain community stability. However, this has been met with resistance from some homeowners.

Origins of the Trend:

The trend of large national single-family rental companies began after the 2008 foreclosure crisis. These companies have seen significant profits during the pandemic as rents and home prices surged.

Wall Street’s Strategy:

Wall Street investors have bundled multiple home purchases into portfolios available for investment, attracting pension funds and mutual funds.

Community Sentiments:

Some homeowners feel that the quality of neighborhoods has declined with the increase in rentals. They associate rentals with issues like trash, loud music, and other disturbances. However, crime data from the Charlotte-Mecklenburg Police Department indicates a drop in reported crimes.

Renters’ Perspective:

Renters feel caught in the middle. They face rising rents and slow repairs from landlords, while homeowners blame them for perceived declines in neighborhood quality.

In summary, the increasing involvement of Wall Street and institutional investors in the housing market has sparked debates about community dynamics, homeownership opportunities, and the role of corporate landlords.

In the ever-evolving landscape of American real estate, the emergence of Wall Street as a dominant player in residential neighborhoods is a trend that cannot be ignored. While this shift brings with it a new set of challenges for middle-income families, it also presents opportunities for communities to adapt and thrive. As homeownership dynamics change, it’s crucial for individuals to stay informed, advocate for their rights, and engage in open dialogues with their communities.

By doing so, we can ensure that the essence of the American Dream remains intact, even as its contours evolve. As we look to the future, let’s remember that the heart of any community isn’t determined by its landlords, but by its residents. Together, we can shape the future we envision for ourselves and the generations to come.